I often refer to 2008 when it is probably the type of “financial crisis” (yes, that’s what it’s apparently called according to Google) that is looming.

But what we didn’t have in 2008 was a strained global security situation, and if I understand this correctly, Europe is mostly dependent on imports today, right?

You can see what the USA is doing – they are forcefully trying to claw back manufacturing and secure natural resources with weapons and threats.

What happened in 2008 – the financial markets were under great strain, which spilled over into the real economy, causing various assets like oil to spike for a while, and I remember freight prices rising sharply.

What if the USA and China sour their relationship with all that we need to buy from China and sea transport is disrupted?

What if a freighter accidentally sinks in the narrowest part of the Strait of Hormuz affecting oil prices?

What if there is a 2008-type speculation in more paper products of natural resources this time, not just gold and silver but rare earth metals, platinum, uranium, and all that?

I have a feeling that the USA will attack Iran – they are not building up the capability they now have in the region just to send angry emails. This is a logistical nightmare and costs are escalating rapidly.

There apparently was a diplomatic marathon last week, but explosions were reported at several locations in Iran over the weekend – rumors say IRGC targets, I have no idea other than the probability of these being accidents is zero.

The ground troops are naturally the citizens of Iran who will manage the ground offensive, and the USA probably wants to do the least possible to ensure their success, without it failing.

Apparently, Malaysia has stopped two Iranian oil tankers.

.Iran is more of a movement for the political Islamization of the world than a government in a functioning country, and they will never step down unless forced to. Right now, they are doing just like Russia, threatening everyone with everything – the parliament stood in military uniforms threatening to wipe out Europe, the USA, and Israel. I don’t know what Portugal did to upset them, but that’s how it is.

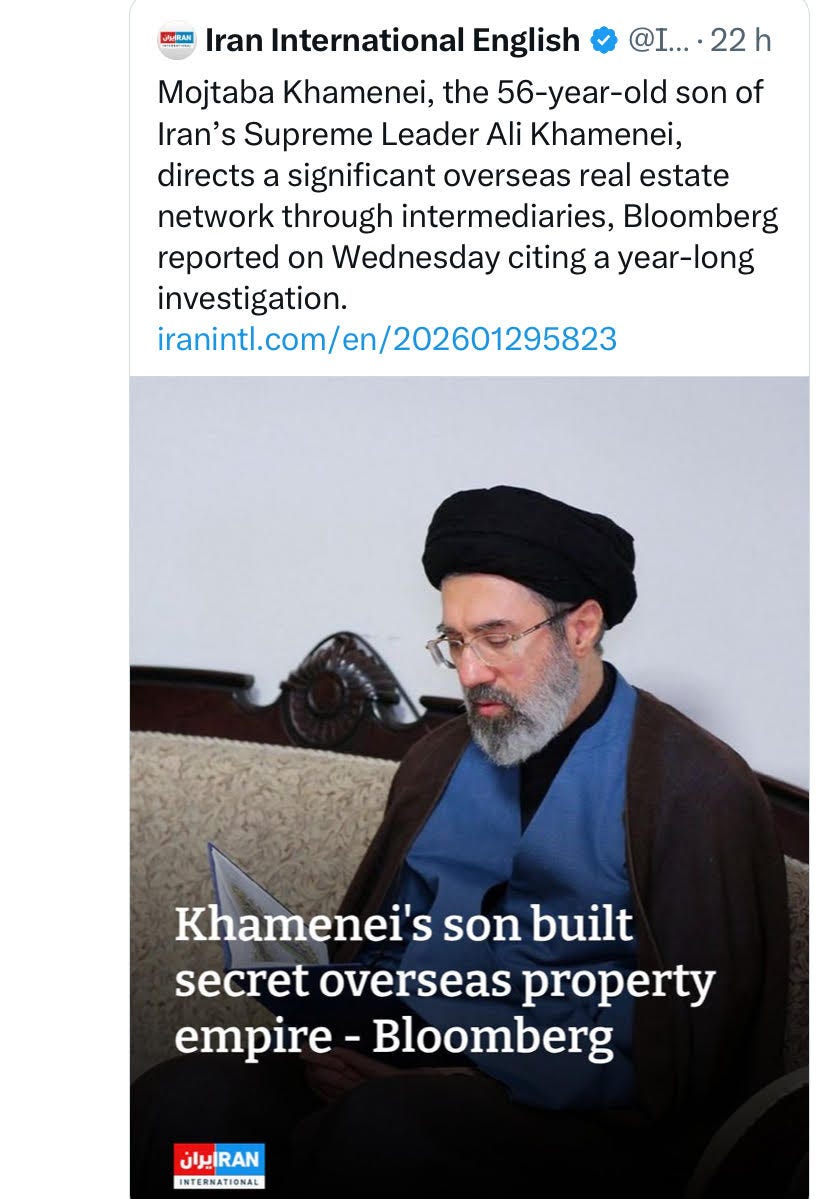

Their children are billionaires living in London, just like all the children of Russian leaders do. They hate and threaten the West while hiding their money, children, and wives living a luxurious life there.

The regime won in a democratic election in the 70s, the military remained passive, and the Shah stepped down – he respected the election loss.

By 2026, the regime has probably forgotten how to respect anything at all and instead has murdered over 80,000 of the country’s citizens who had the audacity to protest against their oppression.

The USA probably wants to impose an oil blockade on China as well, so it’s not impossible that several positives align in their worldview, weighing in favor of an air operation.

Now we got confirmation that the USA is not playing nice with China on January 29 – the USA is clearly targeting China.

Personally, I believe that the citizens of Iran deserve to get rid of the dictatorship and I hope they get a sensible government – if you’re wondering where I stand in this mess.

Most likely, the USA will want someone loyal to them, and it probably won’t turn out well anyway – the world is rarely fair, as we learned from Ukraine.

China’s New Year is around the corner, February 17, then they have our Christmas holiday for two weeks.

Not entirely calm in the neighborhood, in the Persian Gulf, there are the fleets of Russia, China, Iran, and the USA keeping an eye on each other.

Yemen promises to drone away anything in their way.

Iran will retaliate against Israel as much as they can in the event of an attack – and both Israel and Iran have an explicit “mutual destruction doctrine.”

There is a risk that someone fires something at someone, and then everything starts – it usually happens when the pressure is increased too much.

We know that the Russian fleet is incapable of anything, and the Chinese fleet remains to be seen.

Economic warfare seems to be in full swing after January 29, and a group of financial figures usually quoted in the media says so.

Since I posted about the big gold heist, I don’t need to go back there, but in the aftermath of the 2008 recession/crash/correction, JP Morgan and a few others were fined for manipulating precious metals. Apparently, they had a tight grip on silver and could manipulate that asset class as they pleased by flooding it with sell orders that were never executed. They didn’t spend a penny, the asset class went down, and since they were the ones manipulating it, they bought during the downturn knowing it would go up.

If silver isn’t manipulated today, does anyone think so?

Then we had at least two recent occasions where Trump suddenly fired tariff threats out of nowhere, causing stock markets to drop just like that. Then, within less than a week, he retracted the statement, and the markets immediately went up on what they interpreted as good news.

Some with a lot of capital took short positions the day before, or as short as 30 minutes before the unannounced statement, and sold shortly after the statement. Evidence of this circulated on social media, and we declared Trump the most corrupt president ever in a post with screenshots of the positions.

If the Strait of Hormuz is blocked, it drives up oil prices. It would also reduce oil exports to China and Europe, create instability in China, and silence Europe. I wonder why Malaysia, which is oriented towards China, has stopped two Iranian oil tankers, that was interesting?

Now in 2026, if you sit and watch the price of gold and silver in a daily chart, there is a correction downward every day at 10 o’clock between the closing of the London Stock Exchange and the opening of the US stock exchanges. I remember 2008 when it started to go down, and out of curiosity, I started following the markets just like now, it was the same – a daily attempt that you could set your clock by.

Manipulation is there, and major market-moving events do not happen by themselves, even if the media then connects an event to market movements.

There is a lot of planning behind the operation in Iran, and only a few know if it will happen or not – it is worth a lot of money to be privy to the decision before everyone else.

After 9/11 and the Twin Towers, it was discovered that some had shorted airline stocks the week before, right?

When Cyprus locked its banks in the aftermath of 2008, a number of billions escaped the country days before, but all the Brits were there and couldn’t withdraw their money. Then there was a “haircut” if you remember, on all amounts over 100,000 EUR or similar.

It is statistically impossible that all the factors contributing on January 29 happened simultaneously by chance – it didn’t start in one asset class and spread, it was all at once.

If you don’t have insider information when the entire market moves downward, it probably feels a bit like not being invited to a party over the weekend and finding out about it on Monday.

But I am happy because the dollar strengthened again – the sun is shining in my life.

If this continues for a while, it may end up with institutions or banks that do not receive advance information starting to incur acute losses – can losses be hidden until the next reporting period, or are they more creative than that?

If through these market manipulations, for example, Deutsche Bank were to end up in trouble and then in six months they cannot hide the losses – historically, something like that has been enough for a country to enter a recession.

Germany has already priced itself out of the car market today due to the high electricity prices resulting from the shutdown of nuclear and coal power plants to save the environment, the UK is in bad shape after its BREXIT, and the EU has taken on a huge commitment with Ukraine.

I remember the aftermath of 2008 – insolvent banks socializing the losses, crashed dreams of owning a house, and layoffs. The monthly warning list in DI, tearful articles in Aftonbladet with families who couldn’t cope with higher interest rates, unemployed people applying for 200 jobs, burnout, divorces.

And the horror of “falukorv” Friday, how could I have known that Lehman Brothers was not a safe stock 😡

After 2008, we had the IMF in Europe supporting the PIIGS, it went so badly for us that time.

All buttons at once…

I don’t like it because over time it will lead to misery in the real economy.

Then there is another side to this – let the dominoes fall, everyone has to fend for themselves as best they can, and something new will rise from the ashes.

It will be interesting to see how Sweden manages this turn – we have an election in September to start with, and our heavy industry is struggling with high electricity prices + Stegra will soon go bankrupt.

I don’t really know how the banks are being managed at all, but GDP is supposed to be +6000 billion SEK and the total lending of the banks +8000 billion SEK – I don’t know what that tells us?

Then we probably need to see what we are not seeing right now – Russia usually moves under the noise of other things, and China should be under pressure – if Xi removes the entire top military leadership, it is a sign, and China has flown in a lot of material to Iran in recent weeks.

China also just lost control of the Panama Canal, which they intended to use as leverage against the USA.

China surely has a limit to what they can absorb, just like the USA passed that limit a few weeks ago and started to act outwards.

If nothing else, China has flown in a lot of material to Iran and parked naval forces in the Strait of Hormuz.

Don't forget to donate, Ukraine's cause is ours! Support Ukraine!

“Recovery” from yesterday’s record-breaking Russian attacks (not a record in Russian localized attacks but a record in total attacks, including the unlocalized attacks (possibly Ukrainian). Focus on continued attack pressure on Pokrovsk and Huliaipole, a not uncommon combination since the Russians advanced towards Huliaipole late last autumn.

N Slobozhansky-Kursk 0 S Slobozhansky 11💥↘️ Kupyansk 6↘️ Lyman 8↘️ Slovyansk 12💥 Kramatorsk 1 Kostjantynivka 11💥↘️ Pokrovsk 41💥💥↘️↘️ Oleksandrivskij 3↘️ Huliaipole 32💥💥↘️ Orikhivsk 1 Prydniprovskij/Dnipro 0

Sum sectors 126↘️↘️ Unlocalized 53↘️ Total 179↘️↘️

Russian losses in Ukraine 2026-02-02

1083 UAVs is a new record.

SLAVA UKRAINI

179 combat clashes

44 aviation strikes

132 KAB

7,255 kamikaze drones

3,339 shelling (49 from MLRS)

A tense situation and military buildup from both sides with China on Iran’s side. At the same time, it is in the economy that the war is already unfolding. China seems to have a lot to lose economically. XI, who now advocates Chinese currency reserves. One might assume that financially, the war is the financial shark (well, real estate, but nearby environment in NY’s financial district) Trump’s home turf. An area he was born into and has devoted his life to and feels most secure in. With networks. In contrast to previous presidents who in most cases have had either a security policy or domestic policy background (and agenda). Which may give reason to assume that the war will continue to play out on the financial level for some time, with a focus on China as the opponent. If China backs down as support, Iran’s leadership may try to find the nearest escape route.

China thus supports a regime that has just killed 80,000 of its own population, a larger city in Sweden. That continues to produce cars in and continues cooperation with China. 🤑😵💫🤢🤮😵

Europe should stand up, shake off all sick dependencies (oil/gas from Russia, production from China, dependence on the USA for its own defense). Isn’t that a matter of hygiene?

“Over 170 attack drones and a ballistic missile were fired by Russia overnight, during the “energy truce” 2 UAVs are still in the air, but Ukraine took down 157/169 so far – an impressive 93% take-down rate. 12 drones and the missile hit 8 locations.”

https://bsky.app/profile/twmcltd.bsky.social/post/3mducxaflh22z

🎯

“❄️🤷🏻 Murmansk (Russia), minus one more power line, also the power line cables are in critical condition…”

https://bsky.app/profile/maks23.bsky.social/post/3mdugx744yc2x

“❗️🇺🇦Ukrainian soldiers from the “Signum” battalion destroy 🇷🇺Russian logistics in the Lymansk direction”

https://bsky.app/profile/militarynewsua.bsky.social/post/3mdugurkzi22p

“❗️65% of Ukrainians are ready to endure the war for as long as necessary: the percentage has increased (in December and September 2025 it was 62%), – KIIS.”

https://bsky.app/profile/militarynewsua.bsky.social/post/3mduftvzwxs2p