Let’s start by declaring that Operation Turn Off the Lights has started prematurely – it began with RU bombing something in Ukraine so Zelensky ordered to pull down the blinds in Belgorod

Denmark has read the blog and increased the threat level to its energy infrastructure. It’s smart not only because we said it would happen, but also because a new pattern of operations from Russia is to retaliate softly against Europe, similar to what Ukraine does in RU.

Mark My Words – this year and winter there will be quite a few power outages in Europe if the war is still ongoing.

https://energywatch.com/EnergyNews/Policy___Trading/article18587979.ece

However, we are a bit lucky because of the climate crisis, so we will have a very warm winter this year 👍

We have a highly positive bias when it comes to UA reporting and praise the smallest victories while mocking Russian successes – that’s how it should be, but sometimes we need a reality check too.

According to my previous posts from the fall of 2024, Ukraine has an offensive reserve which today in the fall of 2025 is probably quite powerful, but they need full asymmetric warfare to win the war.

So far, we have seen 65% asymmetric warfare according to my world-leading empirical lab tests and still have a way to go.

Russia also has a strategic offensive reserve that they have not shown yet and has more gas at the fronts from existing units. They have just made a major movement and there will probably be a gun duel at Pokrovsk-Kostiantynivka-Novopavlivka, and an attempt at an offensive at the Southern front.

We have been warning about the Southern front for a long time – the units there have not been particularly active and thus replenished and rested.

RU has now withdrawn its task forces from the Dnieper front but has not weakened at the Dnieper – and one doesn’t have to cross the Dnieper at Kherson, right 😀

North of Khakovka, one can almost move to the western side today – you know that if you have carefully read the posts.

Something that has worried me for quite some time is, for example, the following – on paper, Ukraine has more brigades than the attacking RU, and elite units, and yet they are retreating.

Now UA has just confirmed that the staffing is still not great, and after Vuhledar, we understood that some brigades were down to 300 personnel – probably low numbers in the units.

Another issue is that RU has found the combination that works with FAB, drones, kill-chain, digital battlefield, mobile artillery, and some armor. It hurts to be on the defensive, plain and simple.

Ukraine must be mobile and give up terrain before FAB finds them.

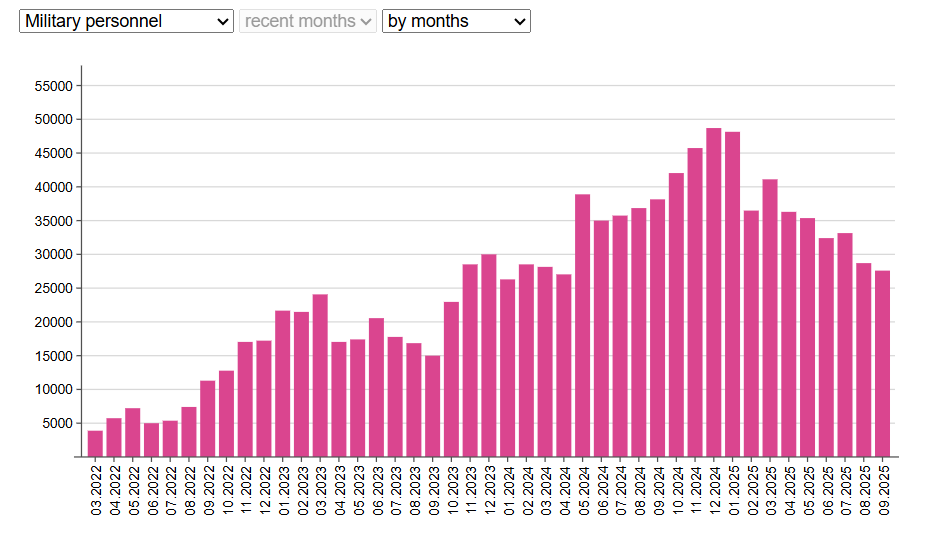

Zelensky recently confirmed a high mortality rate among RU, so the tactic drains RU lives, but so far they are keeping up with recruitment.

Do you win the war by moving backward?

No, of course not, so Ukraine is buying time for other parts in the asymmetric warfare, and it was before the summer that we found their new defense line being built outside of what RU intends to conquer – they are pragmatic after all and do not count on our support.

But it’s rather pointless because the offensive at the Southern front is already beyond that line – RU will not stop at their stated attack goals.

Reviewing the fronts below but first some pictures of RU losses, barbarians are going down and so are hard vehicles. The fact that RU combines this with taking more and more land is a bit worrying.

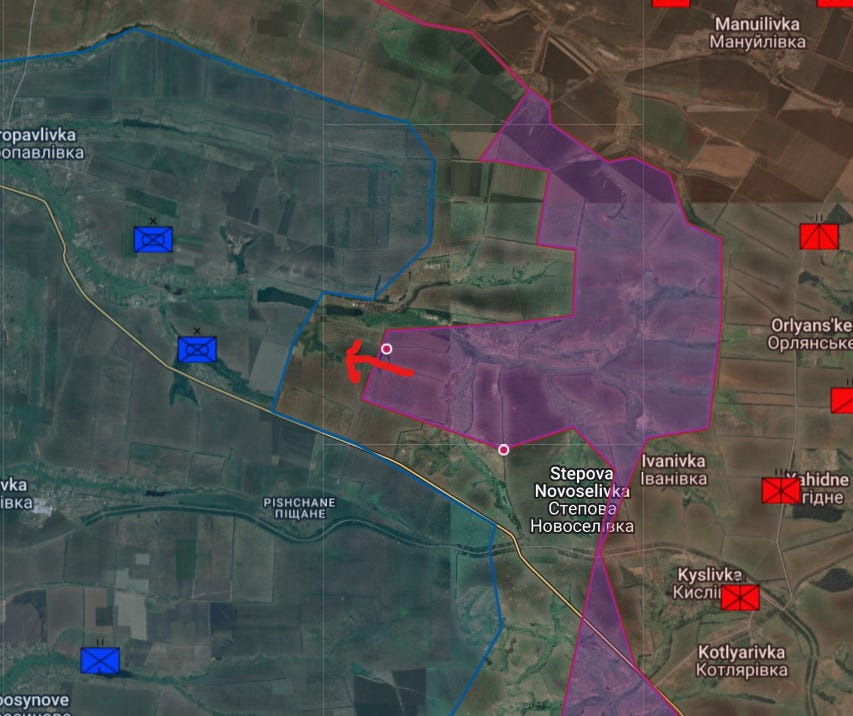

In the north, we have Kupiansk looking like this

And UA has probably already started to leave, as RU made a quick advance here

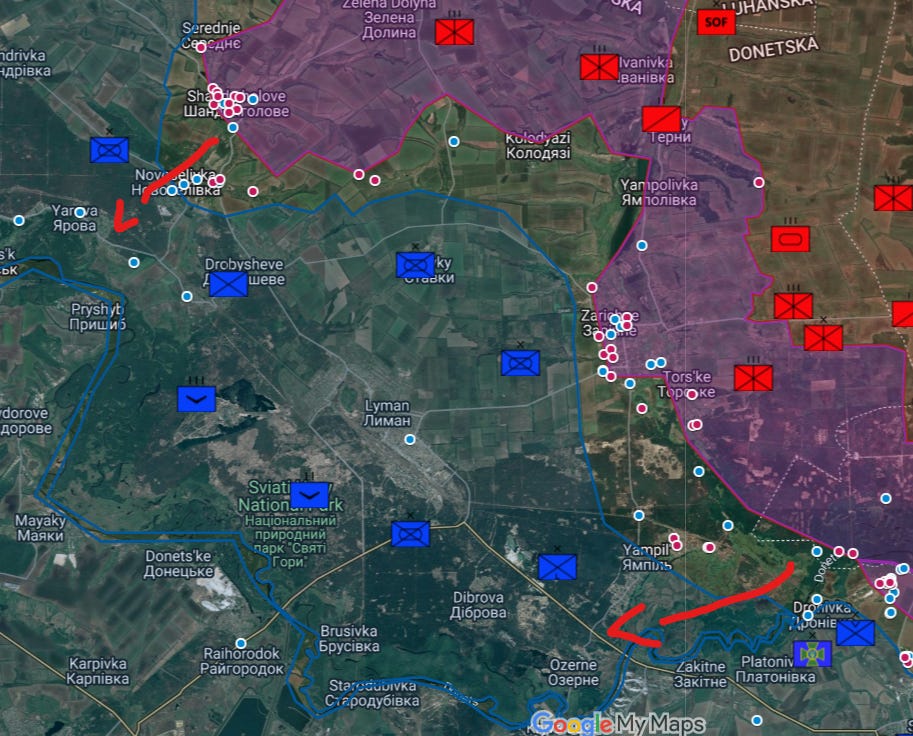

Lyman also looks bad – RU is close to cutting off the area, leaving only a retreat over the waterway

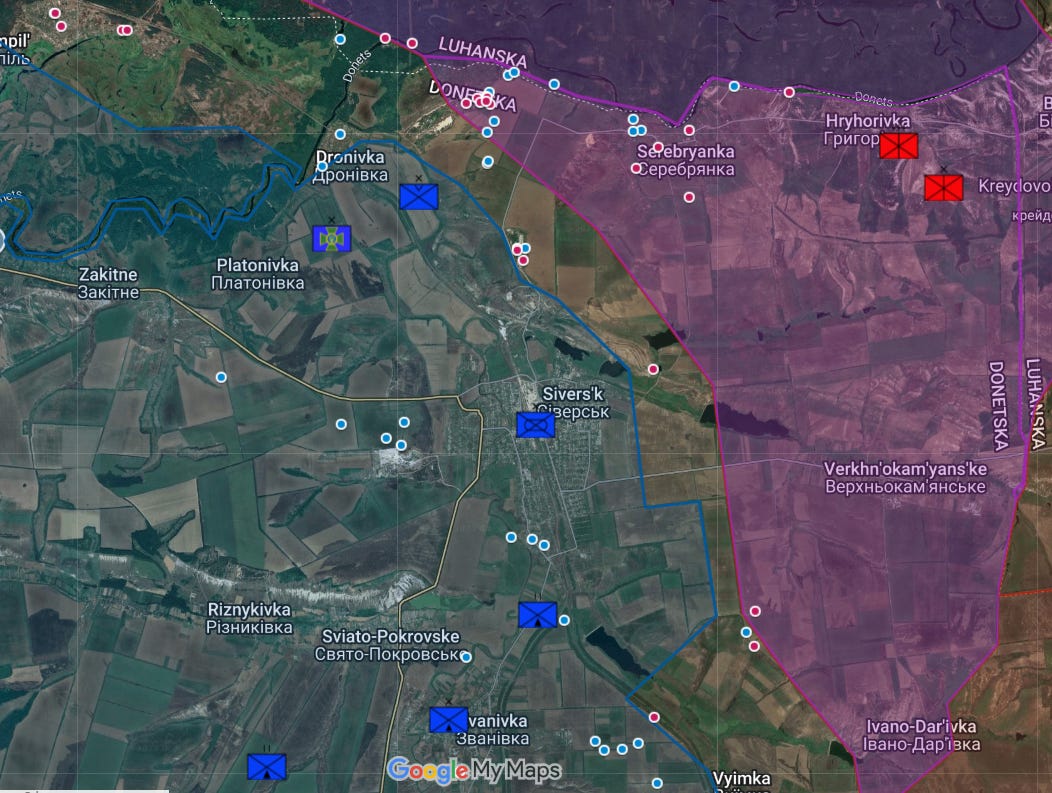

Siversk is not looking good either, there has been significant movement here in silence.

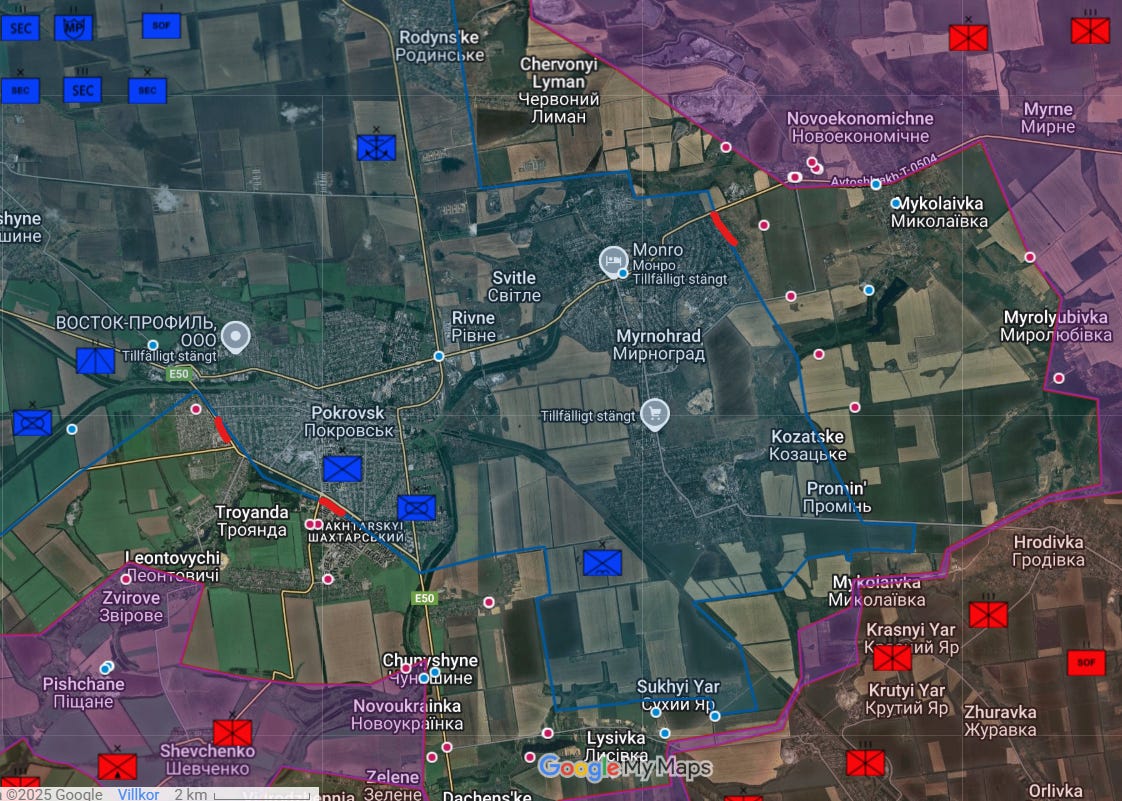

I would like to hear what Gregg has to say about Myrnohrad because it looks like RU has reached there now, RU is also in the southern part of Pokrovsk.

I think these are early signs of a delaying action out of the town now.

Overall, Ukraine continues to give up dominant terrain, and northern Luhansk is an area they can never retake unless Russia collapses as a country.

RU will cross the Dnieper at some point, and Ukraine has very little on the western side.

RU is weak at the Dnieper front and also the northern front, and Ukraine tends to strike on the flanks, but they are retreating on all active fronts.

That’s how it looks in action.

The strategic drone warfare is of course going brilliantly, but now the USA has announced that China intends to attack Taiwan in 2027 and preparations for war are in full swing.

Either the schedule has started to slip or Russia intends to escalate because China needs a pacified Europe when they start their war in Asia.

I see this as a great opportunity – strike at Russia now before China attacks Taiwan, every Chief of Defense in Europe says the same thing – overwhelming force 💥💥💥

If the sh1tland collapses and China hasn’t had time to get started, this could be the end of our era’s major global conflict.

On Substack – there is still a chance to become subscribers and for me it’s valuable if you want to become paying ones. All content is posted freely to everyone, but it still takes a lot of time to put together, costs 80 SEK per month, and then you skip a dinner at McDonald’s, so it’s also healthy – Johan No.1 makes you healthier too 👍

Continued appreciation for the site johanno1.se is

Don't forget to donate, Ukraine's cause is ours! Support Ukraine!

💥 Sleek conclusion: excessive violence, now. All of Europe, USA. And furthermore, Thailand, Japan, South Korea and ultimately Australia, NZ are in the crosshairs. Take advantage of the window until 2027 before China’s planned attack on Taiwan and send everything towards Russia. From the west as well as from the south and east. The risk of depleting Taiwan’s defense? China must choose continued buildup or support Russia. But then we could have the USA fully engaged in the war.

Russian losses in the war in Ukraine 2025-10-01

SLAVA UKRAINI

AFU reports:

💥🔥✊👍

15.7 million tons per year is a lot, as they write the fifth largest in Russia.

“🔥🛢️Russia’s fifth largest oil refinery is on fire this morning. Yaroslavl Oil Refinery with the total capacity of 15.7 million tons of oil per year was targeted. 700km from the frontline.”

https://bsky.app/profile/specialkhersoncat.bsky.social/post/3m24bsriytc2t

If this is true, the refinery has lost almost half of its capacity. Temporarily, until they have extinguished the fire and assessed the damage, the entire refinery will probably remain idle, so we have to hope that it will burn for several days.

“The VT-6 unit at the Yaroslavl Oil Refinery, which vacuum distills fuel oil, was hit. The VT-6 unit’s annual processing capacity is over 6.2 million tons per year. (57.5495030, 39.8047885)”

https://bsky.app/profile/specialkhersoncat.bsky.social/post/3m24cpbxr6k2a

I prefer working with barrels when it comes to oil, as it is the widely accepted term. Why does everyone measure their capacity in tons/year? 15 million tons/year equals approximately 300,000 barrels per day.

As a rule of thumb, I estimate that the world consumes 100 million barrels per day, which means this is 0.3% of global consumption. (consumption = usage in my simple rule-of-thumb world)

Russia accounts for about 10% of global production, so this should mean that 3% of their production disappeared in the blast.

Domestic impact is of course much greater as they primarily use the oil internally before there is anything left for export.

I agree, it’s a bit strange why they mix units but it’s also typical that we can’t stick to the same system..

Barrels are a volume measure and depending on factors like temperature, the energy content can vary. To avoid this issue in refining, weight is used instead because that’s what’s important to know how much can be obtained. It’s more precise that way.

But it’s mostly a question of culture, in Russia and the EU they talk about millions of tons for crude oil, in the USA it’s all about barrels.

When it comes to trading barrels, it’s solved by specifying the volume of a barrel sold at 15 degrees Celsius. In reality, the concept of barrels should be abandoned, but it has remained since the 1800s.

Today there is technology to measure the density of oil regardless of temperature, so it’s not something that can be cheated with either.

Someone should calculate the global cost of everyone converting between the figures, or adding on to convey both barrels and tons.. 😄

When it comes to production losses, maybe it should be calculated against their total refinery capacity. It’s around 265 million tons/year (but can normally be pushed to around 310-320). If the whole refinery is idle, it corresponds to about 5.6%, if it’s just that column, we end up at about 2.3%. That’s calculated based on normal capacity, I think they have a hard time reaching maximum capacity nowadays (or maybe they are forced to run everything at maximum, but it will be bitter when the lack of renovation and maintenance starts to show).

Currently, all gasoline production goes to domestic consumption but they still export a lot of diesel. Diesel is the easiest to extract and you get almost twice as much diesel as gasoline from a ton of crude oil. That’s probably why we only hear about gasoline shortages in Russia for now and nothing about diesel.

I agree with you, Maggan. When you are used to thinking in terms of barrels per day, it becomes really difficult with information in the form of tons per year. Russia has in the past year (from memory) exported approximately 5 million barrels of crude oil and about 2.5 million barrels of products per day.

A suitable measure to compare against. Of course, it can be recalculated. 😕

N Slobozhansky-Kursk 7↘️

S Slobozhansky 4

Kupyansk 5

Lyman 15💥

Siverskyi 7↗️

Kramatorsk 3

Toretsk 14💥

Pokrovsk 51💥💥💥

Novopavlivka 24💥💥↘️

Huliaypillia 2↘️

Orikhivsk 4

Dnipro/Prydniprovsky 5

Nice with a front review!👍

I agree with you that things don’t look so bright for Ukraine. They have indeed been giving up land all along while letting Russia bleed. That in itself is nothing new.

The difference is that the Russian losses have decreased and the ratio when it comes to lost hardware is now around 0.8:1 – 1:1.

Of course, it’s not certain that this also applies to KWIA, but experiencing more hardware losses is not good in itself.

The average ratio has varied but has never been this low. In the fall of 2023 when Russia launched its offensive, it ranged from 1:2.4 to 1:4.7 (30-day average, not individual days) and there have been periods where we were at 1:6 – 1:10.

We have been down to this level, or not quite as low but close, a couple of times before. Late spring/summer 2023 (after Bakhmut and during Ukraine’s summer offensive, as well as around the turn of 2022/2023. So it could turn this time as well.

Russia seems to have almost stopped using armor, on the other hand, motorcycles and other vehicles are also included in the numbers, so one might think it would go the other way, but it’s not impossible that Ukraine is also using more lightweight vehicles. The drone threat is enormous, more lightweight vehicles than larger trucks are probably quite smart to minimize losses. Here, Ukraine still has an advantage with somewhat simpler logistics.

Fingers crossed that the ratio doesn’t apply to KWIA but only to hardware.

If the ratio for KWIA were to be at 1:2 – 1:3, we would have a completely different situation, in that case, the strategy of slowly exchanging land for Russian losses still works.

At the same time, the hope probably increasingly relies on Russia crashing economically and then due to Ukraine striking their refineries. But it will be a race. The Russians are now producing huge amounts of Shaheds and Ukraine’s infrastructure is as threatened as the Russian refineries.

Zelensky mentioned a couple of days ago that the war started in Crimea and it will end in Crimea.

I have etched these words into my memory.

👍

I’m keeping my fingers crossed for it!

Kupyansk, Lyman, Siverskyi

Combat engagements & frontline changes July – September 2025

👍

🧵https://x.com/jplindsley/status/1972963798949728698?s=46

1/ “My former unit would not last 48 hours out there.”

That’s what a US Special Forces veteran said after seeing Ukraine’s front lines.

Eighteen months later, dozens more ex-soldiers echo the same DIRE warning: The West is NOT ready. 🧵⤵️

2/ Western militaries—trained for Iraq, Afghanistan, & “traditional” wars—are unprepared for the drone swarm battlefields of Ukraine.

In their arrogance, they think Ukraine’s situation is something they will never have to face.

🎥imagine if these 🇨🇳drones were armed 😱⤵️

https://x.com/JPLindsley/status/1972963803097907708/video/1

3/ The warning comes from American Deborah Fairlamb in @HJS_Org’s report, “European Defense Autonomy: Identifying Key Companies & Products to Replace U.S. Capabilities” by @DVKirichenko.

Kyiv-based Fairlamb is co-founder of @greenflagvc, funding Ukrainian mil-tech. ⤵️

4/ The awareness gap is deadly.

U.S. veterans who’ve seen Ukraine say Western armies don’t understand:

⦿ drone swarms: land, air, sea

⦿ electronic warfare everywhere

⦿ battlefield adaptation in days, not years

Meanwhile, procurement offices cling to 20th-century habits. ⤵️

5/ Arguments in Washington & Brussels often sound like this:

➡️ “Traditional defense systems are superior.”

➡️ “We won’t fight that way.”

Both are illusions. Russia & China will fight with unmanned systems—and in vast numbers. ⤵️

6/ This isn’t just about Ukraine.

The US demands Europe must carry more weight. That means:

—closing capability gaps

—integrating drones & counter-drone tech

—fusing old and new systems fast

To do so, Europe must learn from ‘Lab Ukraine,’ while also supporting Ukraine. ⤵️

7/ The report reviewed by Fairlamb ends with 11 clear policy recommendations.

Its audience: ministries of defense, parliaments, and general staffs across Europe.

Its urgency: Every lesson comes from blood on Ukraine’s fields. China is watching. Are we? ⤵️

8/ Read the full report here:

https://henryjacksonsociety.org/wp-content/uploads/2025/08/fb59a1d0-c8a0-45c8-b649-c29601779e00-1.pdf

And follow me for daily insights from on the ground in Ukraine. 🧵🎬

We did get confirmation of that with Poland.

Do you think they stole all the information for the report from the thread?

No, not really. Lunchroom Jesus had probably seen the thread. After lunch, they wrote the report.

🇺🇦➡️🇺🇸🇸🇪

🧵https://x.com/anno1540/status/1973051404253085768?s=46

1/

“No prospect of victory”: Girkin stated that Russia needs to “withdraw” from the war against Ukraine

Russian terrorist Girkin (Strelkov) acknowledges the lack of a “prospect of a quick victory” over Ukraine and admits that Russia should “withdraw” from the war if it cannot achieve results. He directly raises the issue of leadership responsibility for failed plans and significant human and material losses.

This was announced by Igor Strelkov’s wife, Myroslava Reginska. The woman published his statements on her own Telegram channel.

https://t.me/i_strelkov_2023/2030

In his address, Strelkov emphasized that Russia found itself in a war it started without proper preparation. According to him, the initial plans were adventurous and did not correspond to the real situation, leading to serious defeats and significant losses.

He expressed outrage that instead of admitting mistakes, the military leadership continues to reward generals who made miscalculations.

https://war.obozrevatel.com/ukr/niyakoi-perspektivi-peremogi-girkin-zayaviv-scho-rosii-treba-vihoditi-z-vijni-proti-ukraini.htm

2/

Igor Strelkov emphasized in his address that Russia found itself in a state of war, which it started without proper preparation . According to him, the initial plans were adventurous and did not correspond to the real situation, which led to serious defeats and significant losses.

He expressed indignation that instead of admitting mistakes, the military leadership continues to reward generals who made miscalculations. In his opinion, this approach only deepens the crisis and creates the illusion of successes that do not actually exist.

Separately, Girkin drew attention to the problems with the fleet and the defense of the Black Sea, indicating that drone strikes and missile attacks on rear areas indicate an inability to protect even its own bases .

He raised the question of why the Russian army, with significant resources, was unable to counter Ukrainian attacks

3/

In conclusion, Strelkov stated that the current situation has a steady tendency to deteriorate. He acknowledged the absence of any “prospect of victory” and suggested that Russia should consider withdrawing from the war if it is unable to fight effectively.

“In general, I assess the situation as extremely difficult and one that has a steady tendency to deteriorate. Unfortunately, I do not consider any prospect of a quick victory over Ukraine “at all” . Because nothing is being done to prepare for victory,” the post says.

As a reminder, Igor Girkin is the former Minister of Defense of the “DPR”. He is currently imprisoned in Russia, accused of inciting extremism.

4/4

Former Foreign Minister Dmytro Kuleba named two fundamentally different ways to end the war.

https://www.obozrevatel.com/ukr/politics-news/mi-nabagato-silnishi-nizh-zdaetsya-kuleba-dav-prognoz-chim-zavershitsya-vijna-v-ukraini.htm

One involves coming to terms with the loss of some territories and building a strong state within the current borders, the other involves long-term preparation for the return of lost lands by diplomatic or military methods.

📖We asked 5 young Ukrainians why they chose to go to war

Despite not yet being subject to conscription, these young Ukrainians are voluntarily joining the military, trading lecture halls for dugouts, or trying to balance both worlds.

https://kyivindependent.com/russia-struggling-to-meet-mobilization-targets-in-occupied-crimea-ukraine-says

Ryssland kämpar med att uppnå mobiliseringsmålen i Krim, säger Ukraina

Ryssland har svårt att uppnå sitt mobiliseringsmål för 2025 i ockuperade Krim, enligt data som tillhandahållits till Kyiv Independent av Ukrainas Center of National Resistance.

https://kyivindependent.com/russia-struggling-to-meet-mobilization-targets-in-occupied-crimea-ukraine-says/

Off-Topic, China

Perhaps some information campaigns would be needed to change behavior. Not only talk about the risks of there being substandard products posing a risk, but also what it will cost in the long run with reduced employment, etc. if all production is to take place in China and other low-budget countries.

“The Swedes are chasing low prices and every fifth Swede aged 20-69 shops at Temu or Shein every month. This is shown in the Swedish Trade report The State of Trade.

The development is a direct threat to Swedish trade companies and the products can pose health risks, according to Swedish Trade CEO Sofia Larsen.

Swedish Trade welcomes competition, but it must be on equal terms. For several years, we have pointed out the risks of allowing Chinese online giants to play by completely different rules than Swedish companies,” she says, adding that it should be in the politicians’ interest to act on the issue.”

https://omni.se/var-femte-handlar-pa-temu-och-shein-direkt-hot/a/B0oadl

I have just found amazon 😳

Off-Topic, USA

“The shutdown of the U.S. government has come into effect as the Senate failed to break the deadlock. The deadline expired at midnight, local time.

The Republicans’ short-term budget proposal, which would have kept the government running for a few more weeks, was voted down by a margin of 55-45. Neither did the Democrats’ counterproposal receive support, and the shutdown is now a reality – for the first time in seven years.

The shutdown is expected to impact, among other things, air traffic and the publication of the monthly unemployment statistics.”

https://omni.se/kongressen-oenig-usa-gar-mot-nedstangning/a/EyO8lj

“A total of around 750,000 employees are expected to be furloughed as contingency plans are activated in connection with the U.S. shutting down large parts of the government, according to statistics from the independent Congressional Budget Office, as reported by several media outlets.

The statistical agency Bureau of Labor Statistics is being shut down, which means that the important job report on Friday will be delayed, the news agency writes.

Agencies affected include the IRS tax authority, the U.S. regulatory agencies SEC and CFTC, and the competition authority FTC.”

https://omni.se/tusentals-permitteras-sec-pausar-granskning-av-noteringar/a/1Mma8l

Trump immediately started blaming the Democrats and threatening various reprisals, so he will probably use this for his dictatorship ambitions.

ISW warns about little green men but in Poland.

They have probably missed the point.

You saw that the USA has moved a lot of capability to MENA, right?

yes, what do they have in the binoculars?

They may be counting on HAMAS and Israel to agree to Trump’s proposal and for them to enter as security forces in Gaza?

Stratotankers 😀

Tasking to send them there without beards…

“⚡️Unidentified drones may have spied on critical infrastructure in Germany, media reports. The drones flew over power plants, a university hospital, military installations, and the official residence of Schleswig-Holstein’s state government.”

https://bsky.app/profile/kyivindependent.com/post/3m24sinyy6c2e

??? Where does Taiwan really stand?

“❗️🇹🇼Taiwan has become the largest importer of 🇷🇺Russian oil, despite being a 🇺🇦Ukrainian ally, according to The Guardian According to the publication, in the first half of 2025, the island imported $1.3 billion worth of Russian oil, despite joining sanctions against Moscow.”

https://bsky.app/profile/militarynewsua.bsky.social/post/3m24ufgqje22b

Wt%

Not the first thing they do unfortunately.

“🚀☠️ The invaders are gathering in the building… but HIMARS strike destroyed Russians!”

https://bsky.app/profile/maks23.bsky.social/post/3m24zqug3gk2j

“🇷🇴🇺🇦 Ukraine and Romania will start joint production of defense drones, – Reuters The agency, citing the Romanian Foreign Minister, writes that the country expects to quickly establish the production of defense drones on its territory for internal use, as well as for EU and NATO allies.”

https://bsky.app/profile/beefeaterfella.bsky.social/post/3m24zlcofl22g

“The EU summit in Copenhagen has started, reports TV2. The agenda includes primarily Ukraine and defense issues, according to DR. The meeting will continue until 5:30 p.m., with a break at 3 p.m.

Following that, a press conference will be held before the EU leaders proceed to a dinner at the castle.

Before the meeting started, Slovakian Prime Minister Robert Fico announced that he will not attend due to health reasons, reports Reuters.”

https://omni.se/motet-har-dragit-i-gang-ukrainas-forsvar-pa-agendan/a/W0npwg

💥🔥👍✊

“🔥 NPS Sukhodolna in Rostov region has stopped pumping oil after a drone attack. The station was attacked by at least 10 drones.”

https://bsky.app/profile/maks23.bsky.social/post/3m24zh3w2hc2j

Wonderful! Instead of making money by selling gasoline, they are forced to buy it instead. Has happened before when they imported from Belarus but that was only for a short period.

“Russia to import gasoline from Asia as nearly 40% of refining capacity shuts down, media reports”

https://kyivindependent.com/russia-to-begin-importing-gasoline-from-asia-after-losing-nearly-40-of-refining-capacity-media-reports/

“The G7 countries are close to an agreement to significantly increase sanctions against Russian oil. This is evident from a draft that Bloomberg has seen.

‘We agree on the need to act together and believe that it is now time for a significant, coordinated escalation of measures to strengthen Ukraine’s resilience and seriously impede Russia’s ability to wage war against Ukraine,’ the statement says.

The G7 finance ministers are expected to speak on Wednesday, and the statement may still change before it is finally confirmed and all seven countries, including the USA, sign it, the sources further state.”

https://omni.se/uppgifter-g7-vill-skarpa-sanktioner-mot-rysk-olja/a/25EWnv

This could become really big.

Has Europe agreed to Trump’s attempt to economically challenge China?

The only way is to impose secondary sanctions on those who buy Russian, which are India and especially China.

If we take on China, it will be lively for a while even for us, but should we come out on top?

I’m ready to take a chance on that from the Caribbean 👍

I haven’t seen anything about the EU and China. I think Trump would need to extend a friendlier hand and maybe discuss reduced tariffs and cooperation, instead of calling Europe’s leaders idiots, if he wants to seriously involve us against China.

We have been skeptical of China all along, even though we couldn’t resist trading with them, but with Trump, we are starting to become skeptical of the USA as well. However, just like with China, we will still have to yield, because it is such an important and enormous market to sell to.

We will probably continue to buy cheap from China and sell at a high price to the USA for a while, but efforts are probably being made to change that. At least when it comes to things we are essentially completely dependent on China for.

Come along – G7 is going to increase sanctions on Russian oil, right?

This presumably applies to buyers of Russian oil as well?

China.

Trump has already started with this, China can’t stop buying Russian oil because then Russia will collapse and it takes a while to recalibrate the supply chains.

So if G7 establishes immediate penalties for buyers of Russian oil, China is in trouble

https://www.politico.eu/article/eu-china-donald-trump-russia-politics-ukraine-nato-tariffs/

…and Taiwan.

We’ll see tomorrow what becomes of it. It’s still just a proposal, and we don’t know how many companies it concerns.

“Three diplomats who spoke to POLITICO said discussions on the EU’s 19th sanctions package, expected on Friday, included the potential addition of Chinese companies to the target list. But that falls well short of Trump’s tariff demand, and Chinese companies that have been added in the past have failed to satisfy the U.S. president.”

25 September attacks were carried out in Bryansk and Samara, right?

What have we had since then until today?

Do you remember MXT when a few weeks ago I expressed concern that the electricity price would be high this winter and you bombarded me with graphs showing that the price was low and that I was worrying for nothing?

I think my post still holds up?

This year’s average price has been volatile and higher than the trend, after the chaotic year it went down every year but now it seems we are going to have another sh1tty year.

Well, but you did prepare yourself for a harsh winter, right?

It might indeed be time for that. It depends on El Niño. It indicates that it might be weak this year, then even the so-called polar vortex could become unstable and then there is a risk that the cold will find its way down to us. At the same time, most other forecasts point to a normal winter or milder than usual.

Then we have the damn Russians. If they cause trouble, it could escalate significantly.

What has the average price been volatile? The hourly price (soon you’ll have to worry about the quarterly prices) or what?

If hourly prices fluctuate significantly at times, it’s nothing to worry about if it’s temporary, one must almost look at the total cost per month to be able to compare, right?

But in the last two months, the price for 2025 has actually increased slightly. If we compare the years between 2020 up to this year, 2025 is just above 2020, 2023, and 2024, but below 2021 and well below 2022.

2022 was not a pleasant year and that’s what I’m comparing with. Prices rising slightly every year is nothing strange. But it’s really November-December that will tell, that’s when 2020 and 2022 took off.

September has actually taken off, found this here but only 2023 and 2024 are included.

August and September 2023 and 2024 had really cheap electricity, so it’s a bit unfair to compare directly with them if you want to match against a normal year.

But we’ll see, there are many factors that can come into play, you might be right and right now it’s leaning a bit in that direction.

But still, I don’t feel any direct concern that we will get 2022 electricity prices (and then I have a house with an electric boiler so it hits quite hard when it takes off).

Europe would probably benefit from 3-4 more warm winters, since +80% of my electricity consumption is in December – February, so a cold winter can probably have its impact, I guess?

I only follow SE3. If SE4 freezes to death, it’s an acceptable collateral damage that we have to deal with, I’m not saying they deserve it, but.

In SE3, the average price for February, May, August, and September has been higher.

After the shitty year of 2022, the trend was that each year it became slightly lower – admittedly only for two years…

Since I am in the electricity underclass, I usually check a bit, and what stood out in SE3 this year was that some days this summer had a good bit over the crown, which it shouldn’t be in the middle of summer – that’s when I probably posted my first post with concern?

—

I forgot one thing in our discussion, when talking to someone in SE4 they tend to be more bitter than I am, and your light-hearted tone always surprises me.

But aren’t you in the electricity area SE2 🧐

And posting graphs above the Swedish average 🧐

You know that if you post a graph of the Swedish average electricity price to a resident in the electricity area SE4, he will burn down your house as punishment, you are a bit lucky with me because I am just wounded.

Furthermore, they have full arthrosis and mold in the walls after trying 16 degrees indoors and cold storage rooms for a few years.

September –

SE2 – 16.32 öre

SE3 – 52.33 öre

SE4 – 70.6 öre

So, residents in the south had 4.3 times your electricity price last month?

If that were the case and you are in SE2, I understand that you don’t care very much 😀

—

I had a bit of bad luck in 2022 because we had moved into a new house and the electricity company that was dominant in the area sold a contract where they were supposed to counteract higher prices but did EXACTLY the opposite. I terminated the contract early in February 2023 but incurred 15,000 SEK per month in December, January, February that year.

At first, we had the network agreement and they strongly recommended this company and especially their contract. The following year, I met some operations manager at the network company where he and his mother had that contract and he spat and ranted heavily about how bad it had been, so maybe they believed in it.

Endless communication with them, they took down information from their website about the electricity contract as I pointed out pure fraud. The Consumer Ombudsman demanded fifteen clarifications and when I missed one, they ruled directly in favor of the electricity company with the justification that I had not provided information on time.

Yet they had all the marketing information from the company’s website that I had taken print screens of promising the lowest price of all electricity companies at high electricity prices in Sweden – and my data showing that it had turned out the opposite.

The electricity company had bought long, very expensive contracts themselves which they pushed onto customers, their business model was that when prices went up, they would have lower prices thanks to long contracts, but it turned out the opposite when prices soared.

45,000 SEK in total to have between 17-18 degrees indoors for three months.

We had an old ground-source heat pump that has now been replaced, was from 2007, cost 165,000 SEK.

So, yeah, I’m not very excited about a repeat of that even though it probably takes a lot before it gets as bad again.

Belongs to electricity area 4. If the cold comes, I will lower the heat so the cost and temperature become plus minus 0.

You get used to the cold. When I sailed in the Arctic for many years and the outside was covered with a thick layer of ice, the indoor temperature followed suit. The warmest place on board was the meat freezer. There we sat in the evenings and played poker (bluff poker…) and drank juice. Unfortunately, the rent also froze inside. Now, it was actually a bit worse, but we seafarers usually downplay things. We simply worry about not being believed. 😇

Haha, yes, if the meat freezer is the warmest place, that’s not good 😀

I belong to electricity area 3, so that old man didn’t work out.

15,000 SEK/month despite having a heat pump?

How many square meters do you actually live on?

By the way, you do know that there is something called insulation and that you can add insulation afterwards, right?

The most effective way is to start with the attic. With 40-50 cm, you’ll have a really good “hat” on the house.

You don’t necessarily need to add insulation to the walls from the outside if you have a facade that is not easy to do it with (or maybe cannot be insulated). It’s just important to be careful with the vapor barrier on the inside so that condensation doesn’t occur in the middle of the wall.

(If you don’t want it to take up too much space on the inside, there are modern “vacuum”-based solutions. Much more expensive of course and still uncommon in Sweden, but then it may be enough with a few centimeters and still achieve good efficiency.)

Quite a lot of what we see is probably when finance/they with pesetas believe that they have now adjusted so they will not financially collapse if we hit China.

Instead, they have positioned themselves for it.

Isn’t the major macro trend of the coming years actually that Europe and the USA will claw back production, buy from each other, and try to extract their own raw materials in Europe and Africa?

If there is a pesetas-run from China, the soufflé will probably collapse as well.

Maybe an economist can tell us how the capital flows are going right now?

It usually gives an indication

The only thing I know is that China has increased its total exports (where Asia and Africa are major partners) and that

the USD has lost a lot against the Euro and a little against the Yuan since the turn of the year.

Soon, by the way, the tariffs should start to be noticed in the USA, when the stocks begin to empty, and then China will probably also notice it more (so far, trade with the USA has not decreased significantly).

It would be great if there was some more global financial insight that could provide a report.

MENA seems to be holding China in its arms?

https://www.china-briefing.com/news/gulf-investment-in-china-2025-finance-energy/

More seems to be leaving than coming into China.

Europe doesn’t seem to be moving in that direction.

And perhaps it surprises you that there is a net inflow into the USA.

Netflow from China to the USA, you mean?

From what I’ve seen, the “trade imbalance” doesn’t seem to have been affected much so far.

I think it could take years before any major changes occur. It takes time to readjust and find new suppliers, or as Trump wants, for everyone to build factories in the USA.

What might affect things more quickly is if consumption patterns in the USA change. If Americans have less money in their pockets, or simply worry about it, and therefore consume significantly less.

Then we will all be affected. 🙂

I meant total capital flows and the USA is positive.

https://www.investing.com/economic-calendar/overall-net-capital-flow-663

China is negative but it seems like MENA has entered significantly, so outflows from China are probably quite large if we exclude MENA investments.

Europe seems stable.

What I believe we are seeing is that capital has started to anticipate a falling China and begun to position itself for that.

Maybe the USA will solve the MENA issue now 😀

China

https://tradingeconomics.com/china/capital-flows

At the same level now as Q3 2024, and Q4 2024 was even worse, so it is not linked to Trump’s politics or anything the EU would have done recently.

I think it is largely due to the major real estate crisis (it accounts for approx. 25-30% of their GDP). Also, many foreign investors suffered huge losses during it and have withdrawn.

Then China has low interest rates, both the FED and ECB raised rates earlier while China has remained to stimulate the domestic economy.

This also causes foreign investors to withdraw from China, they simply get better returns in the USA and Europe.

The USA has not lowered interest rates yet, but it will.

Confidence in China (or at least investing in China) is low but it doesn’t have to be negative as long as the “right” businesses are doing well.

Compare it to starting a company. You can’t afford to invest in the machinery or the marketing or whatever you need. You are looking for, and find someone, willing to fund it, but they want 49% of the company.

A few years later when things are going well, you probably wished you still owned 100%.

On the other hand, if everything crashes, it’s nice not to have to bear the entire loss yourself.

China’s exports are still strong, they still export more than they import, and they can survive without foreign investors but still continue to build up their industry, etc., they will also retain more of the profits for themselves instead of having to share.

Moreover, they are still increasing their GDP even though some are skeptical that it is around 5% and rather believe it’s about half.

I think it’s only when we see their trade balance go negative or the GDP growth completely stalls that we can say hello.

But of course, with such a large outflow of capital as it has been for a year now, they naturally do not want it, especially if it persists for a long time. Chinese companies also need capital to grow and develop.

By the way, Trump wants to lower interest rates in the USA to boost the economy. If he gets his way and maybe even goes too far, it could actually lead to increased capital inflow to China.

Ah, so not the trade but the overall inflow and outflow, then I understand.

But yes MXT, the USA probably needs to adjust a bit to Europe – I think it will happen.

Now they have done it with Ukraine.

I really don’t understand why the USA has behaved as they have since 2022 but now it’s slowly starting to get better.

I think like this – capital flows are two things, partly an indication of what is to come and then a weapon.

Capital is the most trend-sensitive thing there is and they don’t listen to any promises – if they start to believe that a country might be in trouble, they bail out.

When Cyprus introduced its capital controls, hundreds of billions of euros disappeared in the days before. Then all the Brits were left with locked bank accounts.

A country experiencing large capital outflows will face a stock market crash, corporate credit lines will be stopped, they will have to support their currency, and there will be general misery.

Moreover, China is just 30 seconds away from facing trade tariffs from the West, I guess?

But they seem to have the Middle East and North Africa on their side?

However, it also depends on the country’s overall economic situation.

China has already experienced its property crash, and their exports are still doing well. The outflow of capital is of course worrying in the long run, but I don’t believe in an immediate crash as long as they are making more money than they are losing. They will lose momentum if it continues, of course.

Capital flight has been ongoing for several years, but has been at slightly more painful levels for the past year, but I don’t think there will be a crash in the near future. However, we might see the beginning of a slow economic decline.

China has large foreign exchange reserves and very low foreign debt levels, they can probably (unfortunately) manage for many years.

If the playing field changes, for example, through a total collapse of Russia, or if the USA and EU seriously join forces, perhaps attracting a few more, or if China believes it is an opportunity to invade Taiwan, etc., then of course anything can happen.

Do you think that the USA has switched the EU attack on China for taking a tougher stance against Russia?

Would of course be a good catch!

“‼️ Russian Railways August 2025 Loading Update Thread 🌻 Note: Data tables are provided in the thread”

https://bsky.app/profile/prune602.bsky.social/post/3m25bgt2jmc2g

Trump approval rating

Now damn it turns for Trump.

Up 1.9 since last time which gives -14% so now he is back to the level of the previous presidential period again.

The Donald, more popular than ever.

Successful Epstein media black ops?

Maybe after all it’s time for Ukraine to strike against Russian electricity and heat. Maybe it wouldn’t be well received by the West, but personally I wouldn’t blame them, and I must say that I admire them for being able to refrain.

“307,000 residents of Chernihiv region are without electricity due to a Russian strike. Blackout schedules have been put into action. Russia continues attacking Ukrainian civilian infrastructure.”

https://bsky.app/profile/antongerashchenko.bsky.social/post/3m25kr7yfz22g

Guaranteed 100% of this is the plan now in the fall – promise.

Putin will do the same.

“Two hours ago, two Shahed drones flew through Belarus into Volyn before heading toward Poland, according to monitors. In response, Poland scrambled six F-16s. Even more F-16s are now reportedly patrolling the airspace near Ukraine across Poland, Slovakia, Hungary, Romania, and Bulgaria.”

https://bsky.app/profile/noelreports.com/post/3m25i6w7sjc22

“French military has boarded a ship suspected to belong to Russia’s shadow fleet, writes AFP whose reporters have flown over the ship. It happened outside the city of Saint-Nazaire on Tuesday, confirmed by a source within the military.

The ship, the oil tanker Boracay sailing under the flag of Benin, is suspected to have been involved in drone flights in Denmark.

Boracay is on the EU’s list of ships included in the so-called shadow fleet, consisting of ships accused of transporting Russian oil under false flags.”

https://omni.se/fransk-militar-gar-ombord-pa-ryskkopplat-fartyg/a/63xEgz

“‼️ A new modification of the Shahed with a night camera has hit a moving train for the first time in the Chernihiv region. First, the first drone hit the locomotive, which stopped the entire train, and then the drones began to strike other cars in the train.”

https://bsky.app/profile/maks23.bsky.social/post/3m25b3lo2xk2w

Isn’t that a bit interesting?

Direct control or AI?

“En skicklig dyk rakt in i en rysk persons ömtåliga ben. En vägolycka för Sanya och kameramannen – inte deras bästa dag i livet. Ryska ockupanter på en fyrhjuling blev fångade på linsen av en ukrainsk drönare – och straffades omedelbart.”

https://bsky.app/profile/wartranslated.bsky.social/post/3m25nf2plf22u

I am stuck in the submarine violations 😭

Sitting deeply

The war in Ukraine, Russian losses.

980 KIA

1 Tank

2 AFVs

12 Artillery systems

2 MLRS

271 UAVs

29 Vehicles and Fuel tanks

https://bsky.app/profile/matsextrude.bsky.social/post/3m26owc2qas2q

Glory to Ukraine!

I did say that the Chinese bastards would come with swarms of drones.