So what should one always do?

Well, prepare for the worst-case scenario – “if you want peace, prepare for war” because when war breaks out and one is unprepared, the consequences are sky-high.

That’s why one should discuss worst-case scenarios because even though “keeping calm” works in 95% of cases, it didn’t for Finland and Ukraine, and the trauma lingers for many generations after such a blow.

As an elected official, one simply has a darn responsibility towards the citizens to always plan for the worst with the cost in mind, of course.

I have a bit of trouble with Twitter links and the work computer because they want you to work and block most things – all claims without a source below, I have posted a link to on my bluesky, address at the bottom.

Now a full-blown trade war is underway in the world between the USA, China, and maybe the EU, entirely instigated by Trump, one might add –

-China has just retaliated against the 104% tariffs that came into effect on April 9 – they have no intention at all to back down and are raising it to 84% starting from April 10.

https://omni.se/kina-ska-infora-ytterligare-tullar-pa-84-procent-pa-amerikanska-varor/a/8qkXd2

-And the EU is responding to the US trade tariffs, effective from April 15.

https://www.di.se/live/eu-svarar-pa-trumps-tullar-infors-nasta-vecka

-And then, of course, Trump is planning to further increase tariffs against China because they have been rude

https://omni.se/trump-annonserar-tullpaus/a/eMoeJQ

-And yesterday Trump announced that there will be tariff-free for 90 days, except for 10% for everyone except China. Waiting 1-2 days before opening a can of worms is probably the psychologist’s recommendation – an absolutely enormous mess right now, and Omeprazole has increased tenfold in price 😶

Also, the USA has just announced through the loudmouth Trump that they will “soon” impose targeted tariffs on various sectors, such as “pharmaceuticals.” This probably means there will be 10%-50% (who the hell knows anymore…) import tariffs on various products regardless of the country of origin?

Presumably on top of everything else 😀

And the USA has also introduced a targeted port fee only for Chinese ships docking at American ports of 1.5 million USD – on top of everything else, of course.

This summarizes the trade war so far, and both Trump and JD Vance are doing their best to escalate it by going out in the media and on Twitter openly mocking China, Chinese leaders, and Chinese people in general with a thinly veiled racist undertone.

And Hegseth has a very high pitch about the Panama Canal and that China will be thrown out headfirst.

Trump has just given the Pentagon an extra 1 trillion USD to spend 😶

I thought he would reduce defense spending by at least 50%?

The USA has also sent a fleet to the Panama Canal because “it’s ours and not the damn Chinese’s” – that’s roughly what Hegseth has said on the matter, and Panama doesn’t seem to have much to say about it.

To give Israel a fighting chance, Iran must be weakened before the global conflict erupts, so the blow against Iran will probably come soon – as the buildup also suggests. 2 CAG, all stealth bombers, and 300,000 military personnel are in the MENA region now if we include Diego Garcia. And they have moved LV there from South Korea.

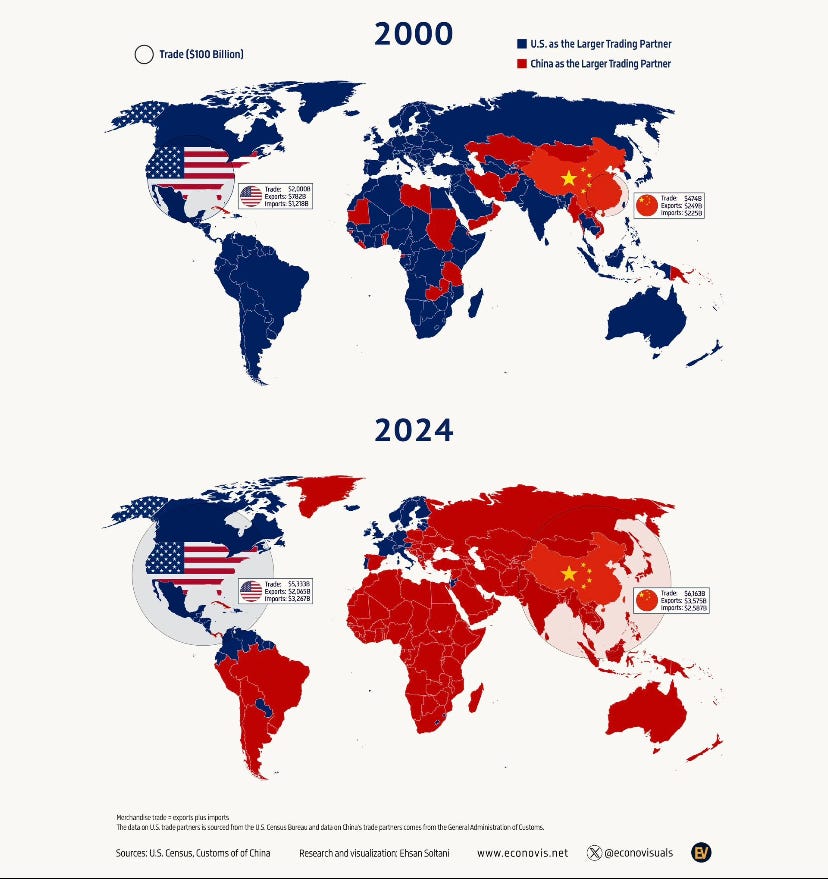

If you look at the image below, you’ll understand why the USA wants to weaken China.

And they need to do it soon so that China’s arms industry doesn’t take off.

Furthermore, the EU is quickly approaching China as we speak, and the USA has seen this for a long time, so it’s no surprise to guess that they would like to keep the EU in check as well, preferably with a cold war managed by Russia.

As soon as China manages to respond proportionally to Trump, he will explode in a tirade of insults and threats that will soon turn into stereotypical racial slurs – I can almost guarantee that.

Zelensky shouldn’t have blown up those captured Chinese right now – unnecessary as the USA is using it as ammunition against China. He is looking for every excuse to escalate right now, any excuse.

The cooperation with Russia is therefore highly selfish and an attempt for the USA to wrestle back to the top, not necessarily by being the best but by crashing everyone else more than themselves.

We have written about this before, but now it’s finally happening – it has gone much faster and much more aggressively than I thought.

Unfortunately, you will receive some of this reporting in the future for the simple reason that the whole situation no longer revolves around Ukraine, but we have now moved beyond what Russia failed with – a global escalation.

The USA sees China and the EU as a greater threat than Russia, and that’s why they have allied with Russia – your enemy’s enemy. Just like the bank, the USA is not your friend, as someone usually says, right?

What happened immediately was that the stock markets plummeted – yesterday Europe seems to have gone down more than the USA and Asia?

And then relief rallies until Trump comes with the next statement – those who know what he will say and when can probably make a buck 🧐

But then there was a first indication that China might be massively dumping its treasury bonds, no one knows right now, and it could also be that no one is buying and China, or others, are selling a bit?

And something broke in the bond market – a reaction like this hasn’t happened since 1982 according to the link.

Interest rates on new treasury bonds are soaring and falling on existing ones if I understood correctly, and this generally drives interest rates up, so the FED must run its “quantitative easing” to keep rates down.

With 2008 fresh in memory, this spread across half the world, and countries got “crisis rates.”

If you remember previous posts, that’s exactly what I was aiming for – will the USA be able to give other countries crisis rates?

The FED can run quantitative easing ad absurdum, but can smaller countries handle it?

Then the next question is what a small Russian attack on the Baltic states and Svalbard would do to risk appetite in a crashing bond market?

That’s how it looked, at least.

Because this is the next question I have asked a few times – has the USA tried to rig this through gross manipulation to come out on top again, and the only thing I can think of is that they are using Russia against Europe for that.

We’ll have to wait and see, but the ball seems to be rolling now, and at least I’m starting to worry about this, add a war between China and the USA on top of the whole mess, and it could get quite lively, I guess.

I will continue to pursue this because I don’t believe for a second that the USA has not prepared a multi-stage rocket.

At least Ukraine is escaping Trump’s ravages for now, even if RU continues offensive operations – there are rumors that they will try to reach Oskil in the future.

Have you also noticed that the refinery attacks, attacks on manufacturing, and other fun things have almost died out in the UA war?

Several weeks without anything here 🧐

Ukraine definitely does not lack drones, and the target list is very long.

Thus politically, but UA must understand that the US peace plan is dead in the water, and RU is literally pouring robots and drones over Ukraine.

What the world needs now is a major Russian defeat in Ukraine, we’ll see if Ukraine can handle it and if Europe will support it.

We had a first discussion at home yesterday about what to do – the answer was to wait and see, it actually took a while to fall asleep after that. Not very excited about this again, the third time during my working life…

If you liked the post, feel free to share it on your channels,

If you want an interesting comment section – johanno1.se. The comments are of high quality, I can promise you that you’ll learn something new every day, and you can also post pictures.

On Substack – now, for heaven’s sake, don’t forget to become paying subscribers, even those of you who already follow. It’s great to see that some find it worth reading, appreciate all the work put into this, and took the step to subscribe, but more are needed 👍

https://bsky.app/profile/johanno1.bsky.social

Swedish rescuers, those I have been in contact with, continue quietly and deliver supplies to Ukraine. You don’t see them constantly on social media because they are instead working to support Ukraine.

Don't forget to donate, Ukraine's cause is ours! Support Ukraine!

Good morning!

Russian losses in Ukraine 2025-04-10

1420 KWIA

3 Tanks

12 APVs

70 Artillery systems

105 UAVs

169 Vehicles & Fuel tanks

4 Special equipment

Glory to Ukraine!

3 tanks feels as exciting as after I have corrected my lottery ticket, it usually also has a maximum of 3 correct ☹

😂

Ukrainian drones have been active tonight, we will have to wait and see if any results are reported:

“Ukraine launched a powerful overnight strike with 150+ suicide drones, targeting military sites in 12 Russian regions and Crimea. Three Russian military airfields were hit. The raid lasted 10+ hours, reaching deep into Krasnodar, Saratov, Voronezh, and beyond. Nowhere is safe for the aggressor.”

https://bsky.app/profile/meanwhileua.bsky.social/post/3lmgpg3wtf72l

“Our new drones in Moscow region”

https://bsky.app/profile/maks23.bsky.social/post/3lmfwsz63ts2n

“Bryansk”

https://bsky.app/profile/maks23.bsky.social/post/3lmfqg2gcjk2n

“Naro-Fominsk, Russia”

https://bsky.app/profile/maks23.bsky.social/post/3lmfxwj47x22n

According to Greyskull, Ukraine has also made some progress. It remains to be seen if this will later appear on DeepStateMap.

“The AFU have advanced between Kotlyny and Udachny Pokrovsk direction”

https://x.com/FreudGreyskull/status/1910091513427833322#m

“AFU reportedly liberated Shcherbaky, Zaporizhzhia axis”

https://x.com/FreudGreyskull/status/1909918421976027234

“Pro Ukrainian channel reports the liberation of Tarasivka, Kostiantynivka Raion Donetsk”

https://x.com/FreudGreyskull/status/1909837398726656221

“Both the Wall Street Journal and the Financial Times write that JP Morgan’s CEO Jamie Dimon’s appearance on Fox News may have influenced Trump.

On Wednesday, Trump said that he had been considering the tariff pause for “a few days” but also admitted that he had seen and been influenced by Dimon’s TV appearance.

– He is very smart, and a financial genius. He has done a fantastic job with the bank, said Trump during Wednesday’s press conference at the White House.”

A bit more about the tariffs

“The decision on Donald Trump’s tariff pause for countries that have not imposed retaliatory tariffs also includes the EU. The White House confirms this to the BBC.

This means that the base tariffs of 10 percent, which the American president declared last week against all countries in the world, remain in place.”

https://omni.se/vita-huset-bekraftar-eu-omfattas-av-tullpaus/a/XjAeWo

The Governor of the Central Bank is concerned about the American government bond market.

“The economic policy of the USA is ‘extremely unpredictable’ and destructive in the long term, says the Governor of the Central Bank, Erik Thedéen, on SVT’s Aktuellt.

He believes that one should be cautious in calling Trump’s sudden turnaround on tariffs good or bad.

– In my view, the major concern is the American government bond market, and it has already started to shake.”

https://omni.se/riksbankschefen-oroas-mest-av-statspapprena/a/4B8VkG

“The Asian stock markets are rising in the wake of yesterday’s relief rally on Wall Street. Stockholm and the rest of Europe are expected to surge at the opening.”

https://omni.se/marknadspuls-asien-lyfter-borsfest-vantar-i-europa/a/637858

Trump did write that everything would work out and that it was time to buy, suspecting that he had already made up his mind when he wrote it.

“A couple of hours later, the president announced that the tariff package that had shaken the market in the past week would be put on hold for 90 days, leading to the third most powerful rally in modern times on the New York Stock Exchange.

– Does it break the rules? I don’t know. Not because Trump follows any rules. Now, of course, everyone will be looking for the slightest signal from Trump,” says fund manager David Wagner to Bloomberg.”

https://omni.se/trumps-tips-betalade-av-sig-bryter-det-mot-reglerna/a/xmv718

“What started as whispers and murmurs exploded into a roar when the news came – President Donald Trump is pausing the majority of his tariffs. Stockbrokers in New York could hardly believe their eyes,” writes Bloomberg.”

https://omni.se/borsgolvet-exploderade-nar-nyheten-kom-total-chock/a/aloy0L

Regarding Panama, it seems they are sorting it all out now. There will probably be more American military presence.

But things move quickly in Trump’s USA, so tomorrow it could of course be something completely different that applies.

“The USA recognizes Panama’s sovereignty over the Panama Canal. Panama states this after a conversation between the countries.

The two nations have reached agreements to deepen American military training in the Central American nation, according to Reuters.

However, the mention of sovereignty was not included in the Pentagon’s English-language version but only in the Spanish version published by Panama. US Defense Secretary Pete Hegseth told reporters that the USA “truly respects Panama’s sovereignty and the Panama Canal.”

https://omni.se/panama-usa-erkanner-var-suveranitet-over-kanalen/a/dR2bMB

Straight ahead?

Did the USA back down?

Ok, agreed then, that the USA backs down but that there should be cooperation regarding some military presence in the form of training.

When one is tired of visiting the USA as long as Trump is in power! 😂 Luckily I hadn’t planned to travel there anyway.

(Yes, it was about visas not tourists)

“USA will reject visa applications based on what the person has posted on social media. The US immigration authority USCIS states that the decision is effective immediately, according to Reuters.” https://omni.se/usa-granskar-sociala-medier-vid-visumansokningar/a/Gymnq6

😂👍🏻

I have one of those special visas for two years, can they revoke it 😶

No, you like Trump, so it should be fine! 😉😂

Operational information as of 08.00 10.04.2025 on the Russian invasion

In total, 149↘️ combat engagements were recorded over the past day.

#Kharkiv 5

#Kupyansk 2

#Lyman 27↗️💥💥

#Siverskyi 10↗️💥

#Kramatorsk 2

#Toretsk 20💥

#Pokrovsk 40↘️💥💥

#Novopavlivka 6↘️

#Huliaypillia 5

#Orikhiv 9

#Kursk 19💥

In the Lyman sector, the AFRF🇷🇺 attacked 27 times. They tried to advance near the settlements of Nadiya, Katerynivka, Myrne, Serhiivka, Nove, Kolodyazi, Yampolivka and in the directions of Zelena Dolyna, Hrekivka and Novomykhailivka.

In the Siverskyi sector, the AFRF🇷🇺 made 10 attacks on the positions of our units in the areas of Bilohorivka, Hryhorivka and Verkhnekamianske, all of which were repelled.

In the Toretsk sector, the enemy carried out 20 attacks near Toretsk, Druzhba, Dachne, Leonidivka and Shcherbynivka.

In the Pokrovsk sector, AFU🇺🇦 stopped 40 offensives by the AFRF🇷🇺 near Kalynove, Shevchenko, Troitske, Preobrazhenka, Uspenivka, Novooleksandrivka, Udachne, Vodiane Druhe, Zelene Pole, Yelizavetivka, Andriivka, Lysivka, Kotlyne, Kotlyarivka and Bohdanivka.

In the operational area in Kursk region, Ukrainian Defense Forces 🇺🇦 units repelled 19 attacks by AFRF🇷🇺 over the past day. In addition, the AFRF🇷🇺 launched 46 air strikes using 82 guided bombs, and also carried out 410 artillery attacks on the positions of our troops and settlements, including eight from multiple launch rocket systems.

Over the past day, the aviation, missile troops and artillery of the Defense Forces 🇺🇦 hit 11 areas of concentration of personnel and equipment, an air defense system and two cannons of the AFRF🇷🇺.

Thank you! These updates are worth their weight in gold!

Tackar! 🙏

Agree with the DJ 👍🏻🌟.

👍

It’s clearly going down in Pokrovsk and up in Lyman.

I’ve been a bit worried about Pokrovsk, even though UA has had a drone advantage, the Russians have sent massive meat grinders right there.

It would be nice with a weekly summary of how the Russian fronts develop over time.

Week conveniently format. At the same time, since progress is often quite slow, a month may be better for visualizing any changes to the front. Perhaps a combination.

“Ryssarna varnades att hålla sig borta från isen. De omfamnade den gåtfulla ryska själen. En liten vind under vårsolen, och isen bröts upp, vilket strandade dussintals. Kredit: The Weather Channel”

Iskalla Ryssar 😁

Frozen Russians 😁

😂👍🏻

The fund that Russia has built up in recent years was actually a war chest intended to be used in the invasion of Ukraine.

We know that now.

That chest has been gone for a while.

But what’s worse is that, thanks to Trump, the oil price is now far below the breakeven point for Russia.

From what I’ve heard, the USA and Russia are supposed to have a new summit soon.

I can bet any amount that Putin will be ready to go quite far to try to raise the oil price while Trump will do everything to keep that topic off the agenda.

Keep an eye out for whether there will be a joint press conference or not, that’s my tip.

In the latest figures, from 2017, Russia accounted for about 80% of Chechnya’s city budget.

If such a large part of Chechnya’s budget goes up in smoke, I can guarantee that there will be a bad atmosphere.

If a Chechen is in a bad mood, it’s best to stay away.

If support for Chechnya continues, the Russians are likely to get angry and Kadyrov will smile broadly and behave very provocatively.

But as I said, nothing hits Russia as hard as a low oil price.

Not even a nuclear bomb on the Kremlin hits as hard.

“For around 20 years, it had a fiscal breakeven oil price of around US$40 pb. Following its invasion of Ukraine on 24 February 2022, though, officially this has jumped to US$115 pb. Unofficially, as wars do not adhere to easily quantifiable and strictly adhered to budgets, the unofficial fiscal breakeven oil price is whatever President Vladimir Putin thinks it should be at any given moment.”

👍

When the stock markets recovered yesterday/last night, it’s nice to see that the oil is still low this morning.

Regular Crude did rise a bit and is now at 61.5, but it’s still the lowest it has been throughout the whole war. The last time it was at this level was in August 2021.

Here is a fairly recent interview with Budanov.

He also mentions that it is primarily the price of oil that determines how long Russia can wage war.

https://kyivindependent.com/russia-to-lose-chance-for-world-leadership-if-it-doesnt-get-out-of-war-by-2026-budanov-says/

👍 Russia is of course more known for what they export, gas, fertilizers, grains, metals, and other things but without oil they might as well shut down. Hopefully the low prices will remain and they can even drop further.

Trump has been insisting that oil prices must go down and OPEC listened to him, at the same time he also wants to increase US extraction (which might be difficult with low prices..).

He really wants to lower the gasoline price in the USA, that’s something the voters appreciate in that car-dependent country. He probably doesn’t care about Russia in that case but they will be the biggest losers regardless.

That is interesting!

Low fuel costs have been as synonymous with the USA as hamburgers, so it is logical that one would want to lower them to satisfy the voters, regardless of party color.

Has the USA had a dialogue with OPEC or is it a coincidence?

As you write, it is devastating for Russia and good for everyone else (if we disregard emissions etc.), including China.

Either they haven’t thought it through completely, don’t care about “Drill baby, Drill” for the moment to then make sure the price goes up when they start drilling (voters have short memories) or it’s 5D chess at a Sheldon level!

Because no matter how you twist and turn it, even the USA will lose out on it in the short term. (Cheap gasoline, no new extraction. New extraction, no cheap gasoline)

Well, Trump is said to have been on the OPEC countries to produce more to lower the price, whether they actually increased or if they have another plan is of course only known by them.

They had planned a production increase which they then tripled. Can’t remember the levels now.

It could be that they thought, okay we’ll do as Trump wants, but we’ll take the opportunity to do a little extra to make it harder for the US’s own production.

In 2014, OPEC did just that, they overproduced to knock out the fracking companies in the USA. Many had to close down as it was no longer profitable to continue producing.

Fracking is more expensive than drilling (on land, not offshore) and today it is the part of extraction that is growing in the USA and accounts for the majority of production.

Furthermore, the reserves are quickly depleted, already within 1-2 years, and then extraction must be moved.

Trump may have gotten a cheaper price than he intended, and then it definitely becomes a problem for the USA, just as you write, because too cheap is not good and too expensive is not good.

Ah, I recognize that about overproduction. 2014.

Trump probably got “A fantastic deal, a beautiful deal. The best deal in history! No one knows better a good deal than I do!” so he let it pass. 😀

😂

I have also been considering the idea that Tr would prefer a price slightly above $60 per barrel, in order to maintain the profitability of production in uza.

Here is an article speculating that this might be a reason why he backed off on tariffs. https://www.cnbc.com/2025/04/10/trump-trade-war-uncertainty-threatens-us-oil-production.html

Unless it was just to engage in some profitable “insider” trading. Other benefits of a high oil price for Tr and his buddy Pu, is that it keeps Russia afloat for a while longer, allowing them to continue causing trouble for us here in Europe.

Tr would probably also want us here to become more dependent on oil and gas from uza. For this to succeed, the price must rise to a level that makes drilling profitable, which means some of the Middle Eastern oil must be eliminated, which could surely be arranged with a few bombs on Iran.

Note that 40% of Iran’s oil exports go to Europe. https://www.iotco.ir/en/newsagency/3235/Iran-oil-destinations#:~:text=Royal%20Dutch%20Shell%2C%20France's%20Total,of%20crude%20oil%20from%20Iran.

I wouldn’t actually be surprised if they go after Iran for that very reason.

New video by Puck. He argues that Russia’s narrative is that they are constantly achieving new successes, albeit slowly. If this trend reverses, it is a danger to Putin himself. Therefore, they will try a new spring or summer offensive. But they only have resources to carry out such an offensive for a short time due to a crashed economy.

https://youtu.be/kmU-Eazta1s?si=pESallRCbZU9WE3r

Yes, progress must be made for RU. In any case, the Russian public must perceive the war that way. Otherwise, there will be turbulence and forces will be unleashed that cannot be controlled by the man at the top of the hierarchy. Whoever that may be.

RU has thus been conducting an offensive for an extremely long time and a rather high-intensity one.

They want to take the area east of Oskil now, among other things.

Thank you johanno1, interesting zoom-out from Ukraine to global. I was exposed yesterday with my manipulations so it serves no purpose to write anymore that I do not intend to address the tariffs. Instead, I will just ignore writing about it.

And now our very own Wunderbaum no. 47 got a feeling and paused them for 90 days after the bond market broke and JP Morgan’s chief tried to explain to the nation and no. 47 that general tariffs against the whole world might not be a very good idea.

An angry toy entrepreneur for children with special needs also had to explain to Fox news and their viewers that it’s actually not China who pays tariffs on Chinese goods, it was he who had to pay. Fox news seemed perplexed and possibly some viewers too.

https://x.com/Ronxyz00/status/1909923574972105114

Now the USA suddenly blinked and is trying to push the narrative that it was all just a negotiating tactic. But before the bond market broke, no. 47 explicitly told several countries including the EU to go to hell with their negotiations. Instead, the country that first agreed to Trump’s demands would be first in line. Probably getting front row seats in the shitshow.

The EU’s strategy to wait as long as possible with countermeasures because US policy harms the USA more than the rest of the world turned out to be fruitful. We also know that the EU is a major shareholder in US government bonds so who knows…

Ukraine is moving forward and just as you write, nothing special has happened on the oil front as far as we know. Could it be linked to the drop in oil prices perhaps? It might make sense not to focus on that area anymore since the fall in oil prices is causing just as much damage. So quick-thinking Ukraine is starting to target high-value military targets such as their strategic bombers. I don’t think they can hit a shot without a hit, but to take down a plane that has just landed, it will probably require a bunch of resources, maybe some on the ground too.

Pure speculation of course, but if oil prices rise and the attacks resume, maybe there is some method in the speculation.

A link explaining why tariff walls don’t work that well. https://www.kommerskollegium.se/globalassets/publikationer/rapporter/2024/economic-backfire-the-costly-impact-of-trumps-proposed-tariffs.pdf

MES!

I actually thought that Trump would impose tariffs on the EU as well – you were right 😀

Yep, you are completely exposed and revealed now 🧐

😭😭

If we assume that Trump is smart and not aiming for Johan No.1’s doomsday scenario where the goal is to crash the whole world, but rather exactly what he’s been saying all along, that he wants to bring in huge amounts of money through tariffs, then he may actually have acted completely right to achieve just that.

He starts by attacking Mexico, Canada, and China with a teaser about raised tariffs. There he encounters some resistance and then tries a different tactic, to impose lower tariffs, 10% on everyone except China, which gets 34% in addition to the 20% they already received.

China responds immediately with 34%, other countries start planning how to react, but before they even get there, he hits them with significantly higher tariffs. At the same time, he threatens everyone not to respond with their own tariffs but to negotiate instead. China adds another 50% and is up to 104%, they respond with 84%.

Perhaps he misjudged the levels, or maybe it was intentional to shake things up. The stock markets soured significantly, many in the USA are critical. Some countries want to discuss with China, and the EU decides on retaliatory tariffs, etc. When the world is in turmoil, he decides to lift the latest tariffs (except against China, where he raises them to 125% and we have not yet received a response).

Everyone seems to go crazy with joy, and suddenly those initial 10% don’t seem so bad, maybe they can live with that. Granted, it’s time for negotiations now, but when we know how it could go with even higher tariffs, it’s not entirely impossible that many countries will accept around 10% without major retaliatory tariffs, and maybe that’s exactly where he wanted to end up all along?

At the same time, the archenemy China has taken a big hit, and it will probably be a show of strength where one party will have to give in. Trump probably won’t give in, he wants China to call and negotiate. On their side, China has only responded in kind and has not gone as far with their tariffs. They probably feel like the adults in the room and probably won’t give in easily either.

I personally don’t think it was planned this way, but rather that the pressure and reactions became too great, and capricious as he is, he turns around when he finally sees which way the wind is blowing. HOWEVER, it could have been that everything was planned exactly like this from the beginning. A classic move, bring out the big hammer and then step back to a lower level to get it accepted.

One issue with the scenario is that if the USA has 10% tariffs while others have lower tariffs, US exports will suffer more than everyone else’s exports all else being equal. So they will slowly become poorer because Trump’s basic premise is incorrect (that tariffs mean other countries pay the USA). Instead, it becomes a tax on imports that hits their exports through increased costs.

Well, I just assumed that Trump was after tariffs. Whether that in itself is smart or not is another story. I also don’t believe myself that the theory that what happened was exactly what he had planned, but for the sake of discussion, it’s good to twist and turn everything.

Yes, I agree of course.

I’ve probably been hit by a touch of silliness in the past few days 😇.

😂 Yes, I have never been particularly interested in the subject of customs before, and now it’s suddenly almost the only thing I think about!

I largely agree. I have always argued that Trump storms into a situation, shouts out something completely insane, and when everyone involved is shaken enough, it all ends up where he wanted it to be from the beginning. He is willing to take almost any risks. It is, or can be, smart. The Trump administration are not fools, their end goal must be determined before it is possible to assess where they are heading.

This does not mean that all plans are good plans. It also does not mean that the plan works (whether it is good or bad) when it faces resistance from others, who may choose to act in a way that is not predictable by the Trump administration. Things can go terribly wrong…

Furthermore, I believe that it is much more important for China to export than what emerges in the discussions. If there is an excess of product X on the market because it can no longer be exported to the USA, what happens to the price? There is no importer of anything who buys from China just for fun. It is purely a matter of price.

China has lost a lot of production to other countries due to higher costs, as their prosperity increases. They have moved up the value chain (necessarily) in order to sell. But how long can they subsidize exports (such as with electric cars)? This is a game of chicken, and I am completely convinced that the Trump administration understands that. Whether they have correctly assessed their own cards and China’s cards, I have no idea about.

What strikes me about the USA is that they have fallen behind in certain areas of their industrial production. If one wants to bring industry back to the USA, it will probably only be profitable if automation can be increased to a greater extent, but I have understood that countries like Japan and Germany are far ahead in robotization. My napkin sketch is that the USA needs the pressure that trade represents for necessary development to occur.

And one disadvantage of automation is that it does not create as many jobs, so the incomes largely end up with the owners.

Yes, 10% across the board might be okay to access a market. That’s probably what the farmers who wanted to enter the market in Stockholm and sell their potatoes had to pay. The problem arises when some have to pay more. Like now, China. On what grounds then? It just becomes a lot of chauvinism.

But wait, do you have a fever? Trump can’t be smart or have a plan, we’ve been told by you…. 😉

He’s not a politician who gropes his way to an island.

He’s a businessman (albeit a bad one) who makes unreasonable demands and then backs off until he gets what he wants.

Not fantastic in terms of negotiation skills, but maybe it’s effective? Perhaps you get more out of it with the latter method?

Well, I’m fine, and I don’t think he’s that smart either! 😂

But there is a slight possibility that it could actually be the case in this situation, and I’m happy to consider all angles if there is any logic to it.

I still believe that there are those in the background who are smart, even if we don’t agree with them, who control Trump like a puppet. As long as he gets to be in the spotlight and appear knowledgeable, he is satisfied. You can deceive a narcissist even if it is life-threatening.

They had not counted on Musk, hence this shitshow between Musk and ministers.

I think you’re onto something here, presenting a worst-case scenario and hoping the world accepts something else. As I see it, I believe the following has happened:

1. Trump et al had a premonition about a “Liz Truss,” and the government bond market started a revolution. If I understand correctly, 8 trillion US Treasury bills need to be refinanced this year, adding 2 trillion USD in deficits, so essentially more than 25% of the entire national debt needs to be refinanced.

2. Who is buying now? The Chinese are not buying, hardly any other countries either. I believe a group of VC/PE has bought a lot of government bond papers, leveraged themselves 20-40 times, and got a nice return as long as everything is stable. When it’s not, things go wrong – compare it to Japan last fall when an unexpected move by the Bank of Japan to raise by 0.25% caused a 10% drop in the Tokyo stock market. The decision was reversed after a few days.

3. Navarro, who is one of the brains behind the tariffs, has probably realized that economic models constructed by PhDs at Harvard are somewhat simplified compared to reality. The idea that “gray/black swans” would appear is probably not taken into account by the models/reasoning.

What will happen now?

I believe the EU has acted smartly here, they have been united (except for Orban) and von der Leyen is likely to increase her power. Perhaps the British will return to the EU – not tomorrow but in 10 years? Or at least closer cooperation. In the long run, I can imagine that Ukraine will emerge stronger from this, I think the country will now receive massive support as Europe probably sees the same thing as Johan no1. Who would have thought 2 years ago that Poland would become one of the key players in the EU?

I would guess that the American administration has cut off so many branches now that the world has had enough. It is already rumored that in public tenders, the bidder’s nationality matters, American companies are not welcome. Not publicly stated, but US-based companies are disqualified in the tender process. We will probably see “Not competitive price” / “Not competitive solution.”

Speaking of Hungary – Orban is now conducting a hate campaign against von der Leyen, Weber, and Zelensky. There will probably also be an artificial referendum if I understand correctly. I would guess that before the year is over, the EU will have neutralized Orban and his veto possibilities. The new German regime has certainly acted that way.

What do you think? Why doesn’t Orban leave the EU if he is so dissatisfied?

Is he not daring enough? Does he realize that he would be screwed then?

Is he afraid that the moment he leaves, Putin will come up behind him and grab him, like a monitor lizard on the prowl at three fifteen, and he can’t avoid it!?

“Hey biscuit, are you standing here crumbling” “Have you ever seen an oiled-up man-guy?”

After all, they do receive a lot of benefits that he doesn’t want to miss out on.

Yuck, that image of the biscuit and an oiled-up Putin is not a picture I wanted in my head! 😂

He needs the money? The EU is a large market. It’s like a four-year-old threatening to run away from home because mommy and daddy are being silly.

He can get that from the Putin boy, as much as he wants if he just does as the Putin boy says.

I think he is really cornered after all these years of obstructing:

He can’t leave partly because of the contributions from the EU as you say, partly because he is fully aware that Putin cannot help him, and partly because he gets zero influence and no veto power with Putin as a buddy.

The EU just has to wait him out.

I used to like cookies 😱.

As mentioned, Orban is completely dependent on EU money. They are also dependent on being in the EU – do you think China or, for that matter, Russia would be interested in Hungary if the country had not been part of the EU?

The money is unlikely to keep coming as long as Orban is in charge – even the Americans have realized how thoroughly corrupt his regime is. The veto power is likely to disappear.

Interesting thoughts and I agree that the EU seems to have done the right thing. Not rushing anything and not backing down either, in addition they spread the countermeasures on three occasions. Balanced!

Yes, that Orbán, we hope we can neutralize or kick out!

Very interesting 👍

Interesting (even though it had nothing to do with customs) 🌟!

Good summary by the way of the customs chaos that has been! 👍

Many who feel bad about it, one can guess

👍🏻

Here it was lively – much more than in China, which still has all the customs duties and other fees including $75 per package sent 😳

It will be even more fun when Trump is going to buy rare earth metals on Ali-Baba 😂.

You made a point earlier – it’s quite clear with what Trump has now introduced targeted towards China, which is port fees, package fees, and tariffs that he wants to reduce Chinese imports to zero.

1.5 million USD per ship that docks and then on top of that 75 USD per package. And on top of all that 104% + ??% which I have forgotten.

I guess there won’t be much Chinese goods sold in the US from now on?

What will be the inflation in the USA now is the big question. A lot of small trinkets will increase in price. First due to scarcity, then when American production starts due to higher production costs.

Aliexpress, Shein, TEMU, and all the others must suffer enormously. A large part of their sales has been small items worth a few hundred SEK.

I also believe that they have a fee for ships manufactured in China regardless of who owns them, at around 1 million USD.

It will be interesting when American companies start exporting maybe…

Imagine him when he brings home a whole shipload at a bargain price that he found there on Ali-Baba, and when he inspects it: “But, WTF, this isn’t Gadolinite, it’s just Styrofoam!”

Friggin 😂!

Rare earth metals are found in Greenland, as can be noted from the discussion. However, more importantly, they are found in Sweden (in large quantities), the question is just when they will start to be mined. I have mentioned it before, but my opinion is that a quick start of mines here in Sweden would be a geopolitical maneuver of gigantic proportions. For example, in Kiruna, one could “simply” start digging in LKAB’s existing slag heaps, but that is not allowed by the state. It must undergo environmental assessment for five to ten years first, with the outcome unclear. (I have previously mentioned Norra Kärr outside Gränna, a gigantic deposit, where the inability to run over/adequately compensate the local population has been total.)

Sweden and the EU could create real power, but then there must be a new attitude regarding orchids, salamanders, or whatever it is that is causing hang-ups. – “You, baby, you” might be shouted by the queers in Stockholm? Oh well, it was quiet…

If handled correctly, we in Sweden could become a geopolitical power factor of great importance. Where we could set conditions, even against superpowers. But that requires courage and decisiveness, which we have not seen much of in this country for a long time.

A certain party is standing in the way of your brilliant idea 😳

A government party?

👍 Wondering the same, could it be the Moderates? Maybe the Sweden Democrats? 😂

🧐

Go MP go ✊🏻✊🏻

Norra Kärr is just a quarry as well, so it’s really a no-brainer for the government to run over everyone because there won’t be any environmental disaster with undrinkable water in Vättern, etc.

I don’t think it has been profitable before, but now it might become more relevant. Of course, it depends on how things go with China. It could end up with prices dropping instead if the US starts extracting its own and China has to find outlets for it through other export markets.

Johan No.1 has decided that we cannot use taxes but that it must be private companies driving the investments, and I think it will be difficult to achieve profitability without support.

I, myself, can consider some support just to make us independent.

Then I don’t know how much domestic production we have where it’s needed. It would be ironic if we had to ship it to China anyway to get it refined.

Those who do not follow that commandment will be crucified 🧐

Tyyyyyyyyyyyyyyyyyst – don’t mention rare earth metals loudly to Trump et al. If Trump et al finds out that we have rare earth metals in Sweden, they will soon suggest that Sweden becomes the 52nd state :-)))))))

🤣

is he going to save the Sami people maybe?

😂

I think it also applies to Finland, it’s the same types of rocks on the eastern side of the Scandes. Should we guess who will be first, Sweden or Finland 😳.

I can live with buying from Finland though.

Sounds almost like the self-proclaimed oracle MXT is starting to reason in terms of Trump actually having some kind of plan 😀

Yes, he has always had the plan to bring in trillions to the treasury through tariffs.

The rest, who knows if it has been so much planned, he has probably just spontaneously gone for the peculiar combination style of mafia boss and grocery store owner:

“Here you have a rotten horse head in the bed, but if you strike now, I promise you an incredible business opportunity that you don’t want to miss! The best deal ever, no one makes better deals than I do. Have you seen what a nice sledgehammer I have here, a gift from Prigozin, peace be upon his memory. We were really, really good friends. There’s nothing to worry about with the sledgehammer, but I hope you hurry to take advantage of the offer before the opportunity is gone.”

I don’t think Trump will be able to sit on his hands for a whole week 😀

😂👍🏻

I will wait a few days before opening a long can and blowing away the danger.

I usually say that what China does will determine the global conflict of our time.

It’s a joke that Trump comes up with a bunch of new rules and then there’s a relief rally because you didn’t get caught – fines and made-up debts.

The EU seems to pause the tariffs against Trump for 90 days at least.

Did Trump manage to withdraw everything in time or is the ball rolling in the bond market?

Question two – can China worsen the situation entirely on its own, they don’t have many reasons right now to rejoice with the rest of us?

I don’t think Trump is done with them yet either – he will demand that others choose between China or the USA and stuff like that.

Yes, the inflation in the USA caused by tariffs on Chinese goods will be massive. How will they be able to compete with the EU then? The only way to maintain the tariffs against China is to demand that the EU introduces the same. It’s a gap that will surely be closed in the coming days. And then the stock markets plummet again because almost everything we use is made in China.

It must be 104% + ??% + 75USD/package + 1.5 million USD/ship that docks. Goods will double in price at least, right?

Then American sales to China will probably be zero in a few days because the state will dictate the terms, and then the curtain will fall, and that export was not insignificant.

Wait here – now we actually know what Trump will do in not too long, insider information 🧐

Now it’s just a matter of figuring out how to short the stock market quickly.

And if Trump DOESN’T close that gap, the EU has a backbone – then his whole plan won’t fall apart, right? 😁

Could Lynx have had a point here, my goodness, how positive one would become in that case 😀

For some goods, inflation is not that high. Take a pair of in-ear headphones, for example. They might be sold for $25 and purchased from China for $3. With tariffs, the purchase cost becomes over $6 (the port fee is probably negligible here). So the final price for the customer is $28.

But for export companies, such a change can still hit hard.

But don’t they come in a package for those who buy them on Alibaba and then slap on 75USD?

Yes, that business is dead. But the headphones you buy at Walmart only increase by $3 in the example above. However, in the example, there is a 10% inflation, approximately, and this will affect the entire board because so much is made in China. So from what I can see, Trump will not be able to let this happen in the USA without the EU taking a similar hit.

Ha, ha, yes, that’s how it can also happen.

“Apple is said to have secretly flown in 600 tons of iPhones – equivalent to about 1.5 million units – from India to the USA to avoid the new tariffs on Chinese imports. Sources told Reuters.”

We can only hope that it is available at the customs warehouses, the fill level of these should vary like a sine curve depending on which tariffs Trump has changed from day to day.

Imagine the extremely expensive measures companies are forced to take, only to have everything change exactly a week later 🤣🤣

It will probably be a “two for the price of one” deal on iPhones in the USA soon.

“The Efficiency Department Doge, led by Elon Musk, has started laying off people at the US traffic safety authority. The layoffs are hitting especially hard against those who review technology for self-driving cars – something that Musk’s company Tesla has received many complaints about.”

🤣

🍿😂!

Nice that he doesn’t have his own agenda at least 😶🤣

According to FOX, it was Japan that started dumping “its debt holdings,” which also forced Trump to abandon his brilliant plan 😶

Was this related to Migrantjohan (are all visas in order so IT doesn’t have to call customs 🧐) above and Japan’s hiccup earlier?

Are they simply too sensitive?

– do you think Trump (self-proclaimed oracle with special guessing, we already know what the answer will be) had counted on that if he stirred the pot a little, there would be a rush to safety in USD and government securities?

And then it turned out the opposite and almost like a matchstick very close to the powder keg?

In any case, I find this interesting because Japan is probably not the country the USA would prefer to crash directly, and then maybe Trump will be forced to calm down a bit 😀

Google says Japan has more USD than China.

So far, the EU and China seem to have managed to absorb the whole blow?

But China is a bit marked right now, and there will likely be more directly targeted extortion attempts from Trump.

I’m changing my mind, it will be a long can tomorrow – it’s Friday, I just realized.

China already has deflation and a gigantic real estate bubble that is being supported by the state. I don’t think they can afford to lose the American market without it having significant effects on the economy.

I believe that we will soon see some form of reaction from China as it is vital for their manufacturing industry to keep running.

At the same time, they are benefiting greatly from the falling oil prices.

It was/is probably what Trump is trying to force reasonably but Japan gave up first?

A question from an amateur then arises – what would happen if the second largest holder of US debt, China, started dumping them on the market?

Then Japan would have to follow suit, wouldn’t they?

So, won’t Trump be forced to back down on all tariffs when it’s China holding the gun to the USA’s head?

If any of the countries start selling US treasuries, “daddy” Powell will fire up the printing press, that’s for sure, aka QE. I don’t think it was Japan that sold off – at least not the state, possibly retail/institutions. The Japanese government is certainly annoyed with Trump, but given China/North Korea and the security situation, I find it hard to see that Japan, with virtually no defense, would provoke since she needs protection.

I’m betting that gold (and silver) as well as other commodities will do well this year. Hands up those who think any country or major institutions (foreign at least) would dare to buy US government securities?

Can someone explain to me how it’s even possible that a company like Apple hasn’t performed worse on the stock market? Now, I don’t follow Apple and don’t know what proportion is manufactured in China, but my gut feeling is that it’s a company that is terribly dependent on China, both in production and sales. How is it that, for example, Apple has only dropped about 20% from its peak?

Will check if I can change my salary from USD to gold 😭

The production in China is just a little electronics and it does not affect the value as much as one might think. The major cost lies in development and marketing, and it is not affected by tariffs.

They are steadily increasing profits, they have built an ecosystem where the devices are interconnected in a smart way which makes those who use more than one Apple product happy to stay.

Their phones still have high status and very loyal customers.

They have managed to make people believe that they are more user-friendly than all alternatives.

They have both phones, computers, and Apple TV but also streaming services for music and movies/series.

Just as they have loyal users, I also believe they have loyal shareholders.

Pretty sure they have high margins on their products, although the increase in imports will raise prices, but I think they will still sell well.

Others will probably take the opportunity to increase their margins by following suit and raising prices.

-20% I think is quite reasonable. They are back to where they were last summer so all the gains during the fall are gone.

Profits in recent years in billions of USD:

What an incredibly ugly table that turned out to be! 😂

If it was Japan that cracked first – can’t China sit still in the boat and let this play out?

Didn’t we write a week or two ago that there are always too many unforeseen events when you shake things up like this – this must have been one of those?

Wesley replied above

You’ll have to excuse me for embarrassing myself on the subject of economics in the Ukraine threads, but this is too funny now that I understand that it was Japan that forced Trump to back down from all countries 😀

So moving on to the next –

Japan holds 10% of 24% of US debt and when they started selling some of it, the bond market almost exploded and Trump was forced to back down and declared a resounding victory?

If China starts selling, or there is domestic sales in the USA, logically this will just be a big smoke screen and then it’s over for Trump, or am I overestimating the effects of a crashed bond market for the USA?

Hasn’t the world just realized how to keep the USA on a tight leash?

Can one rely on China not seizing the moment 😶

A bit tricky, China’s export is dependent on a high exchange rate of the dollar, but if the tariffs become too high, they might as well try to lower the dollar. We’ll see if they can get BRICS on board; one of their goals is to lower the dollar and make it irrelevant.

Now one can almost put Trump aside for a while here 👍

I noticed that it is now called World, daily update instead of Ukraine.

😶

By the way, tomorrow it will be Ukraine again now that Trump had to give up his escalation.

👍

I think we can shut down Trump everywhere, not just here, especially as president of the USA!

😭🧐

Someone posted that SPY calls went up 10 times ten minutes before Trump’s statement to pause the tariffs.

Probably, this is a parallel art of the deal here, insider trading on Trump’s blatant market manipulation?

You know I could have been part of the lucky MXT group, but instead I laughed with you yesterday instead of getting rich 🧐

Guessing that Tr and his gang realize that it’s easy money, so I don’t think he can hold out for 90 days before trying to lower the stock market again so they get a buying opportunity.

“The meeting of the “Coalition of the Willing” starts in Brussels: the Minister of Defense of Ukraine Rustem Umerov has already arrived at the event.

The meeting will be attended by representatives of 30 states that aim to establish a lasting just peace in Ukraine, in particular, by deploying their troops on Ukrainian territory.”

👍🏻

“In his new video, Danish military expert Anders Puck Nielsen pointed out 3 problems for Russia’s offensive: 1. Attrition 2. The frontline is longer 3. Drones favor the Defender (i.e., Ukraine). However, in the short term, the Russians have the resources that they can throw into a spring or summer offensive.”

Sweden plans to purchase Polish-made drones for Ukraine, according to Sweden’s Defense Minister Pål Jonson. He praised Poland’s innovative UAV capabilities and said that part of Sweden’s latest aid package for Ukraine will fund purchases from the Polish defense industry.

It would have been nice if there was some Swedish production of drones that could benefit from the money being invested in sending drones to UA.

“Japan has expressed interest in participating in the NATO mission command for military support to 🇺🇦Ukraine.”

Arigato! 😀

“In first such case, Russia’s ex-proxy in Crimea convicted of breaching UK sanctions. A London court found Dmitry Ovsiannikov guilty of circumventing sanctions between February 2023 and January 2024 on six out of seven counts.”

“It is reported that overnight 🇺🇦Ukrainian drones struck the Sverdlov explosives plant in 🇷🇺Dzerzhinsk, Nizhny Novgorod region. At least three UAVs reportedly hit the facility, damaging a pipeline overpass and two workshops.”

“Ukraina drabbades av en 10% tull på alla sina varor, förutom metallprodukter, som redan hade en 25% tull pålagd på dem i mars; Kyiv har varit inblandat i drama efter att Financial Times läckte det senaste utkastet av mineralavtalet förra veckan; och mer.”

Since the reason the USA did not have tariffs against Russia was because they were under sanctions, the USA had zero trade with them, which was not the case, they had a 4.5 billion USD deficit.

So the question is how much trade the USA has had with Ukraine in recent years that justifies 10% and 25% tariffs?

I find with the help of Google very little and a trade surplus.

Exactly, I checked their steel exports to the USA, it was almost non-existent. Clearly not Trump’s standard calculation for Ukraine.

“On Russian Telegram: Putin fudges the housing crises, with a Trump styled alternative reality. Mutko muddies muddies muddies. Vitaly “let me speak from my heart” Mutko met with Putin today to discuss housing issues in Russia. And there (spoiler) everything is extremely bad. 1/4″

Operators of the 22nd OBSP attack Russian soldiers in the village of Guyevo, Kursk region.

Not completely over with the trade war – Trump clarifies that “bat eaters have 145% tariffs, thank you for listening”.

Trump couldn’t resist and the US stock markets plummeted 🤣🤣

They have probably sold well, so now they are preparing for the next buying opportunity.

“Senators demand answers about insider trading during customs pause”

https://omni.se/a/zA1Xyv

He added a well of 10 to 20% pure reflex.

😂😂😂

One of Trump’s advisors, Pastor Burns, has changed his stance on the Ukraine issue. After his trip to Ukraine, he saw the light, or rather the darkness that comes with the ryzzen.

https://marcusoscarsson.se/ovantat-besked-trumps-radgivare-tvarvander-om-ukraina/

👍 Maybe it can get more people to switch sides.

One can always hope 👍🏻.

I hope he gets to stay, the Godfather might start doubting his loyalty if he becomes too pro-Ukraine.

Stable investment, only 84% down!

“Is there a better representation and predictor of America’s future prosperity under Trump than the share price performance of Trump’s official Presidential crypto coin?

Trump is still promoting this thing.”

https://x.com/RealJakeBroe/status/1910368274468266185?t=N39oifZBW5tFIYVSNBXiyw&s=19

Ebberöd’s bank in a new and larger outfit 👍🏻.

Just like in any pyramid scheme, there is always a winner, guess who… 🤫

Now screenshots are starting to emerge showing severe market manipulation on the US stock exchanges – 10-15 minutes before Trump pumped the market, the bids skyrocketed (or whatever it’s called?).

One isn’t exactly very surprised 😀

This is almost hilarious.

First:

“Experts: Tariff pause does not help – the damage is done

Large parts of Wall Street’s pundits do not see Donald Trump’s tariff pause as a reason to relax.

Investment bank Raymond James and UBS write that enough damage has already been done to raise serious questions about the strength of the market and the economy. The belief in higher inflation also keeps the Fed tied up, says Fundstrat strategist Tom Lee.

– The result is that the market has to turn to the White House for stability, which “is not possible,” he tells CNBC.”

https://omni.se/experts-tariff-pause-does-not-help-the-damage-has-already-occurred/a/93d0Lp

Then this comes:

“Tariffs will cause temporary transition costs and transition problems, says Donald Trump during an ongoing cabinet meeting in the White House.

– In the end, it will be incredible, he continues.

Countries have come forward with proposals that would never have happened otherwise, says Minister of Trade Howard Lutnick, who is also present. According to him, the USA is now getting the respect it deserves.”

https://omni.se/trump-flags-for-transition-problems-with-tariffs/a/lw5L4y

The respect the country deserves? Everyone has completely lost trust now!

The following text translated from Swedish to English:

That’s true, the USA gets exactly the respect they deserve. That is, more and more people are starting to consider crossing the street if they spot the USA.

The comment from the Fundstrat strategist is spot on, a country where the president decides on the economy doesn’t align with a market economy.