Now that one is completely sawed off when trying to discuss based on the situation maps and the less intelligent we have listened to for over two years, it’s time for some alternative posts, but still relevant.

I wasn’t going to write anything until Michael Burry closed down Scion Capital, everyone who has seen The Big Short knows who he is.

My advice is at best bad – I told my brother last winter that in October there will be a stock market crash, it often happens in the fall – and I couldn’t have been more wrong. A good friend also did not buy an apartment in 2014, if I remember correctly, because I thought prices would go down, not advice but I expressed an opinion that he apparently listened to.

Admittedly, we bought ourselves in the deep freeze late 2017 from a couple who had put themselves in insolvency so they had to sell with a huge discount to the only ones who showed up at the viewing, but my good friend in his rental apartment did not share my joy at all for some strange reason.

A financial crash, stock market crash, housing crash, recession or whatever we are heading towards makes countries turn inward – when the downturn will come, no one knows, but that it is coming is starting to become clear.

That’s what we’re trying to do with Russia – crash them economically so they get tired of causing trouble in Ukraine.

First of all, you get internal problems, the opposition smells the morning air and the citizens absolutely scream. Does anyone think that the parties to the left of center would sit down and keep quiet if there were alarming headlines in the newspapers, or would they propose a vote of no confidence at an extra meeting on New Year’s Eve if given the chance?

Secondly, it becomes super easy for Putin’s paid traitors here in the West to start advocating for strict budget discipline. What could be better than cutting back on support for Ukraine, weapons purchases, and then preferably start buying cheap Russian oil and gas again when our budgets are burning and bleeding.

In previous posts, I have argued that the USA is trying to trigger a crash so that everyone runs back to the dollar, and that China then suffers the most. The USA takes an initial hit in order to export the atomic bomb blast to someone else – it’s pure speculation and free thoughts.

But something that is not pure speculation and free thoughts is that Russia would very much like to see us in the West in the same sinking economic boat they are already in. They are happy to provide a black swan – that is, a triggering factor. They have already tried that and they will continue to try until it works.

At some point, all that is needed is a really bad news to get the ball rolling, and Russia is a major supplier of bad news.

The question then is whether the EUR area is resilient enough or if we are facing a new 2008 with a new catchy name, or if it will be the PIIGS again perhaps because everyone lacks imagination?

With a little luck, maybe we can isolate it to the UK, which apparently is close to sovereign bankruptcy according to Bloomberg.

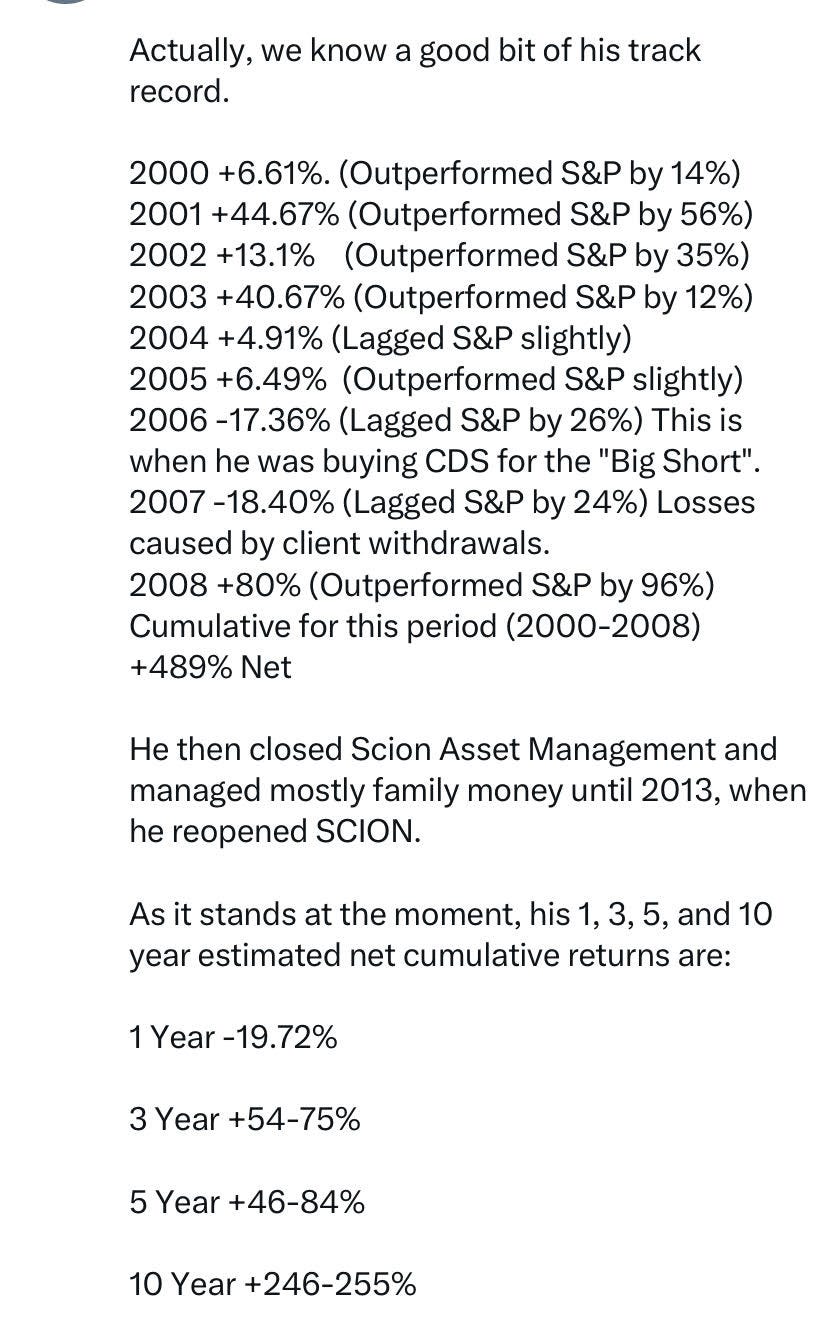

Michal Burry has had enough now and says he can’t stand the valuations in asset classes anymore, and a united #fintwitter mocks him as a “one hit wonder.”

Of course, I went in and checked what he had earned since 2008 – very good, probably better than those who are now mocking him.

A very important truth is that you can be completely right but if the timing is wrong, you will fail – many have comforted themselves with the fact that at least they were right when they moved into the rental apartment in Bagarmossen and are experimenting with different types of soy sauce on rice with a moving box as a table.

Then Burry shorted in Palantir and probably tries to drive the process through his platform maybe 😀

Now in the spring of 2025, I started to consider saving in stocks (again) and it is a strong signal that it has made its way into the media reporting in the final stretch, but this is something I don’t follow at all.

The last time I did it was during the Dotcom bubble where a few months before the crash, I walked through the doors of Nordnet with 45,000 SEK in hand, which was half a year’s student aid.

During the downturn, I tried to buy the stocks I believed in, Gandalf, Framfab, Medialab for example, were recommended by exactly everyone who guaranteed doubling of the stock price.

I asked those in my circle of acquaintances who had previously talked up the stocks but they had no tips at all anymore and were directly dismissive – everyone had only chased the stocks that were going up just because they were going up and then found arguments for why they would continue to rise. Real stock market legends until they weren’t anymore.

With some anxiety – buy, sell, and buy again down to a portfolio value of 1,635 SEK. A classic “trying to catch a falling knife” operation that should be written about in history.

Then I sold the crap, closed the account, dropped out of the University of Edinburgh, worked my way through the recession of 2007-2008, and have been working ever since.

There were no more stocks after Dotcom because I have been running the race house – children – job – trying to survive covid.

I followed the 2008 crash with interest as a leech because I had 1999 fresh in my memory. I was working in Angola at the time and it was calm there, did a stint for three months in Basingstoke in the UK and was struck by how worn out everyone was – they looked like vampires.

We were at my cousin’s wedding in Spain for two weeks on a long vacation EXACTLY when Lehman crashed and I bought a paper newspaper every day and sat and read at a café that had good sausage sandwiches. I felt a bit like Warren Buffet I thought because I didn’t lose any money.

On #fintwitter, there are now guys who have had a portfolio since around 2015 at the longest. They have probably amassed everything between one million to 14-15 million among those who have been there the longest.

The newer ones have started in the last two years.

Everything is supposed to go up according to everyone – it’s a “bull market” and nothing is overvalued at all, and they post the weekly gains. Everyone is actually just looking at stock prices, chasing quick gains, and then trying to find arguments for why it is sustainable – I recognize that from my own career as a stock market shark.

In 1999, it looked like this – the little molehill was 80% down and it took 13 years to get back to the top.

This one is excellent, someone bought CISCO at the top and thought “computers are the future.”

Fun anecdote actually, everyone wanted NETFLIX but if you bought Dominos Pizza instead, you would have had the same stock journey as Netflix apparently.

In October and November, there have been a couple of sharp dips – BitCoin took a big hit and many accounts faced margin calls, they had leveraged themselves and it went below the limit so the bank takes your account and you are left with nothing.

A whole bunch of #fintwitter have leveraged portfolios with leverage I have discovered – this seems to be quite common now, which means that larger downturns are amplified when forced sales kick in.

It seems like we are back to those financial instruments described in The Big Short but on a much larger scale.

I think the “AI bubble” has great similarities with the “Dotcom bubble” – AI companies are valued at insane P/E values (multiples), they don’t earn much, they promise trillions and manipulate assets and costs.

For example, Michael Burry pointed out that they double the lifespan of NVIDIA processors or whatever it is – an accounting trick to inflate the valuation.

It is mostly the AI sector that has surged and those belonging to it, many other companies are struggling and performing poorly.

Already now I have seen a couple on #fintwitter – “XX has gone down, sold and bought into XX instead which has strong fundamentals”…. “why isn’t XX doing well, they had a very strong report.”

Here comes the tricky part –

Stocks have risen far above reasonable valuations already, especially AI, and the downturn that is looming is nothing but a “deflation” of the system back to reasonable valuations.

You think it’s unreasonable because you bought in at the top and use that as a reference for what is reasonable.

And then the cycle starts again – those who find the next APPLE or NVIDIA at the bottom after the deflation (or maybe it will be them again) will make X times the money this time too and everyone will say “I should have stayed long and never sold.”

When it goes down, everything goes down but not at the same time, and “sitting tight” or “buying the dip” is equivalent to a quick suicide.

Even worse is selling those that are going down and trying to buy something else that hasn’t gone down yet hoping that that stock will go up so you can regain your former glory – when the new stocks start going down, you lose even more than the index and that’s exactly what I managed to do – I beat the index but in the wrong direction ✊✊

You have every chance to see your portfolio erode by 80% over six months and then your wife will demand that you close the account and use the remaining funds to pay off some of the mortgage. You also have to promise to never mention the word stock again in the family’s presence as you have started chain-smoking and downing whiskey on weekdays – that’s how many a bull has left their budding career and become a tired parent with a second-hand Mazda instead.

If you have never seen a major crash and have found something that has worked for you for 15 years, the risk is sky-high that you will continue in old tracks, think Michael Burry is a loser, and accelerate straight into the wall.

At least I have decided not to start any stock savings before the “AI bubble” bursts, and then we’ll see if I still have a job after that – then maybe I will start recommending the next “stock rocket” for you and you can buy in by swishing me, best price.

So what happens when it goes down (we don’t know when) – this will probably start in the stock market and then the ripples will spread and cause major cascading effects.

The first group to be affected will be #fintwitter who learned the hard way and hopefully managed to minimize the damage, but there will be no new Teslas, fine dining, or home purchases for a couple of years.

Layoffs will also start and it’s already a bit shaky now if I understand this correctly. Our unemployment rate is already at 10% today so it will get worse than that.

Exports will decrease significantly and this time we may lose market share if we are not very cautious – which of course we won’t be because we are supposed to reduce emissions by 90%.

The central bank may lower interest rates below zero, so maybe no skyrocketing interest rates for mortgages in Sweden, but fewer buyers in real estate sales and we will probably see many summer cottages at bargain prices.

The “AI bubble” will reverberate in the real economy and there will be some tough years.

Then we have government bonds/national debt, especially US ones that have been considered a neutron bomb. When Trump started playing tariff director, it almost exploded after a few days and he had to slam on the brakes.

China – if they eventually collapse under pressure and enter into a fully bloomed epic Chinese crash with full cascading effects, it could get lively?

Once it starts, a lot can happen and then historians will point out the brilliant steering and those who knew exactly what they were doing, but see it more as a game of pick-up sticks where those who quickly figure out which sticks to loosen fare the best.

We will move from “this is a new economy” to “the world is ending, jump into the lifeboats” – and then after a few years, it all starts again.

The question is whether China and Russia managed to advance their positions during this time or if it is the USA that manages to outmaneuver China – we shall see.

I have actually given up hope a bit on Europe, but maybe we will surprise in the end?

Don't forget to donate, Ukraine's cause is ours! Support Ukraine!

Good morning!

Russian losses in the war in Ukraine 2025-11-17:

1160 KIA

2 Tanks

3 AFVs

17 Artillery systems

1 MLRS

2 Anti-Aircraft systems

213 UAVs

72 Vehicles & Fuel tanks

Slava Ukraini

https://bsky.app/profile/matsextrude.bsky.social/post/3m5skdme53k2a

Today Johan no 1 writes a lot about stocks and the stock market. I don’t understand that stuff. I don’t understand much about Ukraine either, but I imagine that my 13 months in the navy and “kommisatlanten” (Hårsfjärden) automatically make me an expert on all conflicts in the world 😐 The only thing I can brag about regarding stocks is that I have kept my Fermenta stocks. 🤑

Johan doesn’t have much regard for the leader of the UK, Prime Minister Keir Starmer, I have understood. Starmer has apparently taken Johan’s words seriously and started at Saab. As a lobbyist.

Read Omni last Friday. (Found the text today as well) You have to scroll to defense news. It concerns Poland, which Starmer is now lobbying for a submarine collaboration with Sweden! What could be the reason for this?

It’s no secret that Sweden and Poland want a future submarine collaboration, decisions will likely be made before the end of the year. Possibly, these will be equipped with British air defense missiles. Hence Starmer’s interest.

But thanks for the post, Johan no 1.

Addition to the above: “kommisatlanten” was a joking term used by the sailors of the merchant navy. Many of them sometimes made fun of the sometimes aloof seamanship of the navy. Of course, that was not the case, as the navy had its tricks, and the merchant navy had theirs.

“Kommis” is a Swedish word derived from the French “commis,” which I believe means constable.

👍

The slightly insane attacks in Pokrovsk continue and yesterday around 4 p.m. they were up to 51 assaults. However, only half of these during the latter half of the day, which is probably due to the Russians avoiding night combat.

The very intense attack peaks at the beginning of November have been followed by a still increasing “rest day” in terms of the number of attacks, but this rising bottom, or “support” to borrow vocabulary from the above theme, seems to have been broken in the last few days.

There was a report from K Gregg yesterday that may explain this broken support:

“Finally, I would like to share some information from the resistance movement ATESH

“💀 The occupiers are rushing troops to Pokrovsk due to a lack of reserves

According to informants within the ATESH resistance movement in the area around Vuhledar, as well as agents among Russian military personnel, the occupiers are urgently moving forces towards Pokrovsk.

Every day, military vehicles carrying soldiers are moving towards Pokrovsk. These troops appear to be taken from the front sections at Kherson and Zaporizhzhia. The Russian army has clearly exhausted both its main forces and its operational reserves in order to continue the offensive, and is therefore forced to quickly weaken other parts of the front.

Agents from the 506th Motorized Rifle Regiment report that hundreds of soldiers are arriving in their area every day. The new arrivals from other units are immediately sent into battle, sometimes without even being registered in the new regiment.

The information confirms that the Kremlin is trying to take Pokrovsk at any cost, regardless of the enormous losses in both manpower and equipment. They continue to send new forces straight to their deaths.”

https://x.com/coxoxoffoxoffic/status/1990238107908874382?s=46

N Slobozhansky-Kursk 0↘️

S Slobozhansky 6

Kupyansk 8↗️

Lyman 23💥↗️

Slovyansk 8↘️

Kramatorsk 6↗️

Kostjantynivka 32💥💥↗️

Pokrovsk 75💥💥💥💥↗️

Oleksandrivskij 21💥

Huliaypillia 14💥

Orikhivsk 1↘️

Prydniprovskij/Dnipro 1↘️

Latest from Atesh:

❗️ “ATESH” agents report an increase in chaos and friendly fire among the Russian Armed Forces near Pokrovsk

Our agents from the 110th Guards Motorized Rifle Brigade, part of the 51st Combined Arms Army, report a new systemic problem in the Russian troops: UAV operators are increasingly striking their own assault units. This has become a common occurrence at the tactical level, happening both day and night.

Most often, the strikes hit assault troops operating with infiltration tactics. Due to the lack of identification marks and general confusion, drone operators often mistake them for the enemy and open fire. The reasons for the chaos are clear: the haste of the command demanding to take Pokrovsk and Myrnohrad by the end of November; massive losses and the influx of untrained reinforcements instead of destroyed personnel; failures in interaction, communication, and coordination between units. According to our agents, losses from such “friendly fire” are already measured in dozens.

Against this backdrop, open confrontation is growing between the assault troops and UAV operators. Shootouts have been recorded, and the assault troops increasingly accuse the drone operators of allegedly “working for the Ukrainians.” Losses from such “friendly fire” are already measured in dozens, and the offensive in the Pokrovsk direction is noticeably slowing down.

📩 Don’t become expendable material and a target for your own drones. Join “ATESH”!

Write to: @Svyaznoy_Atesh — confidentiality and rewards guaranteed.

https://t.me/atesh_ua/8595

FP-5 “Flamingo”

https://bsky.app/profile/specialkhersoncat.bsky.social/post/3m5src54zts2y

I also believe that there might be a minor shakeout in AI, and of course, it will to some extent spread to the entire stock market, but I don’t think we will see the same thing as when the IT bubble burst.

There were many more branches involved last time, everything from computer manufacturers, telecom companies, and internet services to subcontractors of various technologies. The bubble was driven by an overconfidence in how quickly we would change our behavior. Suddenly everything was supposed to happen over the internet, from e-commerce to streaming TV and everything else.

At the same time, companies raised huge amounts of money based on pure hopes of becoming world leaders, for example, in e-commerce. They raised multi-million amounts in capital and hired people without coming up with functional solutions. The few who actually managed to build a webshop or other internet service discovered that the market was not ready. Simply put, there weren’t enough customers. It’s difficult to recoup a few hundred million in investments if you then sell goods for 100,000 a month with a 10% profit margin. Additionally, investments were made in numerous companies promising the same thing.

We also had companies that were supposed to develop hardware and other gadgets to enable fast and stable transactions online and in telecom (to handle the influx of streaming video, billions of card transactions, etc.). Even the telecom sector and mobile phone manufacturers (who were also supposed to earn enormously) and of course computer manufacturers got caught up and overvalued.

It looks different now.

Regarding AI, today it is mainly already profitable companies that are doing well (Microsoft, Meta, Apple, etc.) and are investing in AI both as additional services and to streamline their own operations. Both Meta and Google currently use AI for managing ads, etc.

Even companies like Open AI, although far from breaking even, have a functioning business model in place where they are already making money. There are also some smaller companies using AI to create services that generate revenue.

More and more companies are offering AI as part of their offering. Adobe allows users to create images and videos using AI (a small part is included in the subscription, if you need more you have to purchase it), but AI is now also used in their tools to enhance several functions. This doesn’t directly bring in money, but it gives them an edge.

There are AI-driven services where you subscribe to their services, for example, to create music (or get help with certain parts), etc. AI is already here and is being widely used by many, and people are willing to pay for it.

So, it is a big difference from the start-up companies during the IT bubble that had ideas they managed to get people to believe in but never managed to complete or find customers willing to use them.

AI is being used more and more today.

The AI industry is probably overvalued and may be adjusted when it turns out that the revenues may not reach the levels hoped for after all. But this will mainly affect large established companies that have income from other sources. It is not impossible for Microsoft, Meta, etc. to drop by 10-20% if it turns out that the business model is not sustainable. If the giants reduce their use of AI, it could of course also affect Nvidia, which could plummet even further.

But the question is, will we really use less AI in the future?

Will NVIDIA’s chips remain unused?

I rather believe it will only increase, and we may instead see prices rise, fewer free services, etc. We are still in the early stages, so I suspect that prices are reduced compared to the actual costs to get as many people as possible to adopt the new technology. Once everyone is hooked, more can be charged.

Regardless, if there is a crash, it will be within AI. The major companies affected do not operate on promises of grandeur; most are already established in other areas. Regular computer manufacturers will not be affected, nor will telecom, etc.

Therefore, a burst AI bubble will not hit as hard as when the IT bubble burst. If you are worried, you should probably pull out of AI companies, but I don’t think other industries are at risk of crashing in the same way, although they may also be dragged down to some extent.

Even if everything dips slightly, it was the same after the IT bubble, where traditional functioning companies quickly recovered.

Buffet is probably right, but I believe the crash will be much more limited to just AI, and most companies will be able to absorb and survive the crash, unlike last time when many bankruptcies simultaneously wiped out billions in invested capital.

People are, of course, as they are. It could lead to everyone selling everything in panic, and therefore completely sabotaging the entire stock market, but I think it will mainly affect small investors this time.

I am not worried, but I would also generally be cautious about investing in the stock market right now unless it concerns a company in a completely different sector that looks promising.

Regarding the image that Johan has included showing the hump when the IT bubble burst, one can easily get the impression that everything is extremely more overvalued today.

At the same time, stocks on average increase by about 10% per year (if not adjusted for inflation). Therefore, the curve is not as strange as one might think.

Firstly, one can see that the curve quickly returned to normal after the crash. So, those who did not invest during the hump had a fairly normal development. Secondly, the peak at the end is not as dramatic, but rather relatively normal.

If you invested 100 SEK 30 years ago, the development looks as follows with a growth of 10% each year. That is quite close to the actual development. Therefore, the high level at the end is quite natural with the exponential growth that occurs with the “interest on interest” effect, and thus does not necessarily indicate any serious overheating or overvaluation (when looking at the stock market as a whole).

The problem is that the great interest usually comes two years or less before the peak for the media to start writing about stocks.

And then you lose a lot if you sit still.

You have more now, right?

Electricity production.

Server halls.

Hardware for server halls.

AI software.

AI.

After Dotcom, the strong companies survived and today we got.

The only thing I saw the same back then was the inflated stock prices, quantum stocks have fallen 50% below or something from the top.

The multipliers today are at 350 or something which is completely unrealistic.

Well, as I write about AI, there is probably a high probability of a downgrade and sure, you are right that there are a few more related businesses that could be affected but I believe in any case that the big crash will be limited within that sector even though of course it will also to some extent spread.

UNLESS everyone starts to panic and begins to sell everything without thinking and of course there is a risk of that.

The more people write about it being a bubble and that it will burst, the greater the risk that it will do so without necessarily being supported by fundamentals.

“❗️Zelenskyy and Macron besökte högkvarteret för de multinationella styrkorna i Koalitionen av de Villiga. Högkvarteret för styrkorna, ledd av Frankrike och Storbritannien, inledde operationer i Paris för flera veckor sedan.”

https://bsky.app/profile/maks23.bsky.social/post/3m5tajqhhj224

“❗️🇺🇦Ukraine will receive SAMP/T air defense systems with enhanced characteristics (!) earlier than 🇫🇷France itself, — Macron. Paris is currently upgrading them.”

https://bsky.app/profile/militarynewsua.bsky.social/post/3m5ta42qjtc2t

When will it arrive in Ukraine?

Great! 👍

“🇪🇺🇧🇪🇺🇦 EC promises to protect Belgium if Russian assets are used, – Politico. The European Commission has offered substantial guarantees for a €140 billion loan to Ukraine to reassure Belgium that it will not be left alone in the face of legal or financial consequences for the use of Russian assets.”

https://bsky.app/profile/maks23.bsky.social/post/3m5tbg6p4hs24

⚡️ Romania evacuating village after Russian drone struck LPG tanker on Ukrainian side of border. Between 100 and 150 people are to be evacuated from the Plauru village, which lies just across the Danube River from the Ukrainian port city of Izmail, hit by a Russian drone attack overnight.”

https://bsky.app/profile/kyivindependent.com/post/3m5tb5ewdec22

https://kyivindependent.com/romania-evacuates-village-after-russian-drone-hits-gas-ship-on-ukrainian-side-of-border/

“15 people have been evacuated from a village in Romania after a Russian drone attacked a gas ship by the Ukrainian shore. There is a risk of an explosion, so people were brought to safety. Russia is a threat to Europe.”

Film:

https://bsky.app/profile/antongerashchenko.bsky.social/post/3m5t5cyf56k2o

Good that Macron has understood it!

“❗️The transfer of additional weapons systems to Ukraine, including Rafale aircraft, will not make France a belligerent party, — Macron. According to the French leader, the country has long since delivered Mirage 2000 aircraft and other equipment, and this has not led to escalation.”

https://bsky.app/profile/militarynewsua.bsky.social/post/3m5tamuxtdk2t

“❗️🇺🇦Ukraine and 🇫🇷France have signed an agreement for the supply of 55 electric locomotives, — Zelenskyy. According to the President, this will significantly strengthen Ukraine’s logistical capabilities.”

https://bsky.app/profile/militarynewsua.bsky.social/post/3m5tae75lzs2t

“The GRU special forces are once again hunting enemy air defense systems in Donbas. The targets included the Tor SAM system, the radar station of the Buk-M3 SAM system, and, as reported, the command post of the S-400 SAM system.”

They have probably been working on it for a while now, right? Anyway, it’s good that Trump is finally mentioning it, maybe it will actually happen in the end!

“❗️Trump confirmed that Republicans in Congress are working on a bill that would impose sanctions on countries doing business with Russia. He also added that Iran could be included in this bill.”

https://bsky.app/profile/militarynewsua.bsky.social/post/3m5sq3trlak2x

“🇵🇱🇺🇦 The explosion on a railway line leading to Ukraine was likely intended to blow up a train, — Donald Tusk. ❗️Meanwhile, Defense Minister announced that the military will inspect the remaining 120 kilometers of track leading to the Ukrainian border.”

It seems that the influence operations in Poland are starting to border on pure and simple terrorism. They are testing Article 5, with things they can deny.

“⚡️ Russia keeps targeting residential areas in Ukraine. Local authorities showed the aftermath of a Russian missile strike on Balakliia.”

https://bsky.app/profile/united24media.com/post/3m5t5pskw6i2z

“The Dobropillia–Kostiantynivka highway, briefly cut by Russian forces during their push on Dobropillia, has been retaken by Ukraine’s Air Assault and National Guard units. Burned vehicles now line the road. It was a key logistics route, and the area remains high risk.”

https://bsky.app/profile/noelreports.com/post/3m5t4mfkqdc2d

“🤬 4 “Shaheds” attacked a target in the Odesa region.”

https://bsky.app/profile/theukrainianreview.bsky.social/post/3m5t3jnmfks27

“❗️🇵🇱Polish Lieutenant General Maciej Klisz reported that on the night of September 9-10, when dozens of 🇷🇺Russian drones violated Polish airspace, some of them were equipped with explosives.”

https://bsky.app/profile/militarynewsua.bsky.social/post/3m5t2zregcc2v

Oops – the general truth was that they didn’t have any components?

That makes the matter somewhat serious.

Still, there were 23 of them.

https://united24media.com/latest-news/absolutely-real-threat-polish-general-says-russian-drones-carried-explosives-during-border-incident-in-september-13507

And why haven’t they told it earlier, in order not to escalate?

The Russian’s plan worked, and now they are escalating by blowing up railways.

“🥴🤡Hungarian Prime Minister Viktor Orbán has stated that Ukraine “has no chance” of winning the war and described further EU support as “pure madness.”

https://bsky.app/profile/militarynewsua.bsky.social/post/3m5szvnty7c2v“

Orban should be taken out in a protective hunt

He has probably been promised some part of Ukraine if Russia wins.

There should be some regulatory framework within the EU to remove those who clearly work for a foreign power, especially in this case when the foreign power is in a cold war with the EU. He is a security risk.

“⚡️ Ukraina samarbetar med NVIDIA för att bygga ett suveränt nationellt AI-system. Digital minister Mykhailo Fedorov tillkännagav en ny initiativ som inkluderar en statlig AI-infrastruktur, talangutveckling, gemensam FoU, support för startups, och en Diia AI-språkmodell byggd på ukrainska data.”

If this is true, it’s really good, although when I look at the official data for Urals oil, it’s at 55 and regular Crude at 60. 55 is indeed among the lowest during the war, even though it has actually been down and turned to 49 for a short moment.

“🛢️ Russia’s flagship oil price plunged to the lowest in over 2 1/2 years last week, – Bloomberg The price of the nation’s Urals grade plunged as low as $36.61 a barrel from the Black Sea port of Novorossiysk. Discounts on Urals deepened to an average of $23.52 a barrel against the Brent benchmark.”

https://bsky.app/profile/maks23.bsky.social/post/3m5tcfijphs25

Yes, it’s at 53 dollars 🧐

Looked at a longer graph and it’s not really a crash in anything, not even something suggesting less buying interest.

It will be interesting to see which parties will be affected when it’s time for us to go to the polls.

Both parties support Ukraine.

“With one day left until the local and regional elections in Denmark, several parties have been subjected to cyber attacks. AFP reports.

The websites of the Conservative People’s Party and the Unity List were temporarily down this morning. Even those who visited The Copenhagen Post, an English-language Danish news site, encountered an error message.

A pro-Russian hacker group claims to have targeted several Danish parties as well as the Danish Broadcasting Corporation, which, however, tells the news agency that its operations have not been affected.

The same group claimed responsibility last week for attacks on several Danish municipalities, government websites, and a defense company.”

https://omni.se/cyberattacker-mot-partier-infor-lokalval-i-danmark/a/gwX5eA

“❗️Russian forces in frontline areas are increasingly actively using Iranian Shahed-101 strike drones. It is reported that the drones were manufactured in 2024 in Iran and supplied to Russia for attacks on Ukrainian territory.”

https://bsky.app/profile/militarynewsua.bsky.social/post/3m5ti3e4bhs2t

Did you see that RU blew up a railway in Poland that is the line to Ukraine?

Now the cold is probably starting to come as well, so maybe some power outages?

The risk is imminent, they seem to be moving towards direct acts of terrorism.

I have never been more certain in my life about anything 😀

It would be appreciated if the electricity price stayed at the current level or lower as it’s starting to get a bit cold now and the kWh usage is increasing 😶

Right now, SE4 is more expensive than Germany, the UK, and Denmark.

Marginally, indeed, but since we export a lot to them, how is that good business?

RU knew that there was a component in the drones, so when Poland stated that they did not have it, or whoever it was that made that narrative stick, Russia got proof of Poland’s unwillingness to go to war with them.

Yes, asked the same question higher up before I read down here.

Russia knows that Poland does not want to escalate, so they escalate themselves until it stops, and then they deny everything.

Time to stop being afraid, heavy attack on the Baltic Sea fleet 💥💥💥

I see that the interest in stocks is overwhelmingly high – also received good feedback on Substack where the only comment was that I should never deal with stocks👍

Japan and China argue over words

https://www.theguardian.com/world/2025/nov/17/china-and-japan-are-in-a-war-of-words-over-taiwan-what-happens-next

Taiwan has become a prestige project for Xi similar to Ukraine for Putin. Xi has stated that Taiwan should be reunified with China, and cannot back down. Real dictators need to have these “projects” to show their power, even though the people probably think they are a bit silly and believe there are better things to spend the money on. Unfortunately, the people have no say in the matter, they just have to keep quiet and hope to be left in peace.

The dictator is provoked by the resistance they receive from the outside world, because in their imagination they are always right, and they stick to the decision they have already made. They do not need to compromise since they have not needed to discuss the decision, and consider themselves superior to everyone else. They take criticisms from the outside world personally, as they believe they know best, and respond to these with violent threats.

Before Chiang Kai-shek fled to Taiwan, it was actually under Japanese rule.

China has completely fabricated that Taiwan is a province of China and the whole bit.

The wind power generates 22%…

The electricity prices are rising